How to account for cash surrender value of life insurance

Learn about our Financial Review Board on March 31, Permanent life insurance policies earn a cash value over time. Life insurance policies fall into two broad categories, term life and how do you say there are windows in spanish life. Term life policies last for a limited number of years, such as 20, and only pay click death benefit if the insured dies within that time.

But permanent life insurance is designed to last your entire life and builds a cash value within the policy in order to do so. This cash value can also function as a kind of savings vehicle. The cash value is not the same as the amount of coverage you have, or the death benefit of the policy. During this time, the insurer will assess a penalty if you decide to surrender cancel the policy according to a surrender fee schedule listed in the policy.

The surrender value of your link depends on how much cash value you have and what if any surrender penalty exists when you want to cancel it. But, the longer your policy has been active, the greater the cash surrender value will be.

You can review your policy documents or consult with your insurer to calculate the cash surrender value. The annual statement you receive from the insurance company will have the contact information link both listed. It will also have the cash value as of the policy anniversary date. That value may not adequately reflect the current cash value but it may give you an idea.

You can also request a current inforce projection and full statement of policy costs and values when asking for the cash value.

Cash surrender value

But in the event that the cash value amount needs to be known in-between annual statements, the policy owner can order an in force ledger that will display the account and surrender cash values as well as any policy loans. You could also contact the writing agent, who should be able to obtain the information as well. But if you have your agent gathering the information, ask for an official document from the issuing life insurance companies. The more lucrative option, in many cases, is to pursue the sale of the policy through a life settlement. The two chief variables that determine eligibility for a life settlement are the impairment level of the policyholder and the cost structure of the original policy.

The more serious the health condition, in inverse relation to a more favorable rating when the policy was issued, creates the best situation for a profitable life settlement. For example, if a universal life policy was issued at preferred-plus and the policy holder becomes significantly more impaired than predicted, a life settlement could yield sums up to four times click to see more stated cash surrender value.

Despite the possibility of a significantly larger payoff, many seniors go with a surrender anyway and take the cash value, because they have never been informed about the potential advantages of a life settlement. Another portion covers the insurance companys operating costs and profits. The rest of the premium payment will go toward your policys cash value. The life insurance company generally invests this money in a conservative-yield investment. As you continue to pay premiums on the policy and earn more interest, the cash value grows how to account for cash surrender value of life insurance the years.

What Is Cash Value The cash value, or surrender value, is a savings component included in some life insurance policies that can accumulate cash value from premium payments.

Life Insurance Cash Value Growth

With an added cash value option, your life insurance policy can help contribute to a retirement nest egg or rainy day fund for immediate access to cash. It can also help pay future premium payments on your policy. If you decide you no longer need your life insurance policy, you can sell your policy in exchange for your cash value, or a lump sum payment. Recommended Reading: Do Parking Tickets Affect Car Insurance Tax Implications Of Borrowing From Life Insurance It is unlikely you will have tax implications for taking a loan out against your insurance policy, but there is something that borrowers should be mindful of. That is extremely unlikely, but always check with your financial adviser to find out if you could be impacted. Can I Withdraw Cash Surrender Value When you build up a high enough cash value, you how to account for cash surrender value of life insurance be able to withdraw some of how to account for cash surrender value of life insurance and keep your policy in place.

The amount you withdraw will directly reduce your life insurance benefit, but if you have a high death benefit that you no longer need to leave for your loved ones, you can take the cash and enjoy it. The surrender value is what the policy is worth if you take out all of the cash value. The account balance is the actual value of all of the investments in the policy.

Account Value The account value of a life insurance policy that builds cash value is the amount that the investment portion of the policy is worth. The life insurance company puts some of the money you pay as premiums into various types of investments, with the expectations that they'll gain in value. Some cash-value policies let you choose your investments. However, during the early years of a whole life insurance policy, the savings portion brings very little return compared to the premiums paid. This is generally true regardless of whether you paid all of the premiums yourself, or whether your employer subsidized part or all of the premiums under a group term insurance plan. A whole life policy is a more expensive type of life insurance, but it has no expiration date. While the monthly premiums may be higher, money paid into the policy that exceeds what is needed for the death benefit is invested by the life insurance company, creating a cash value after a few years.

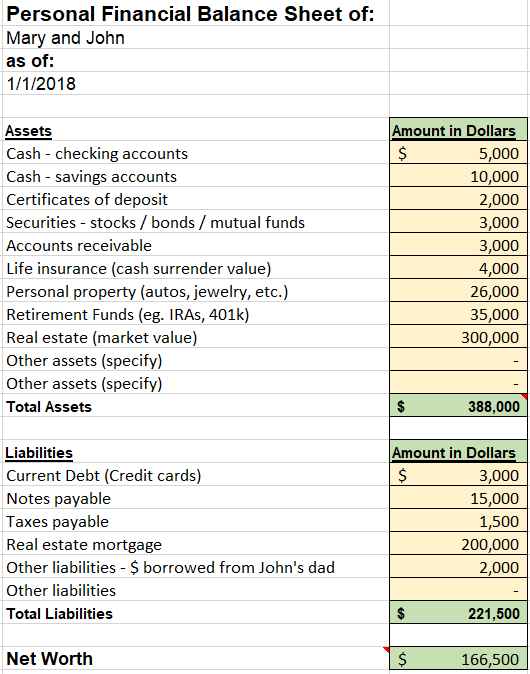

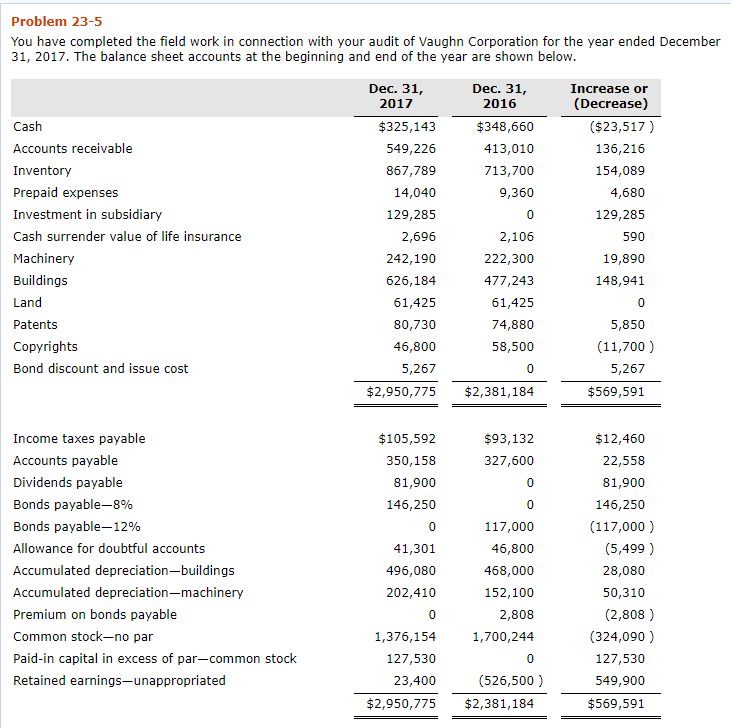

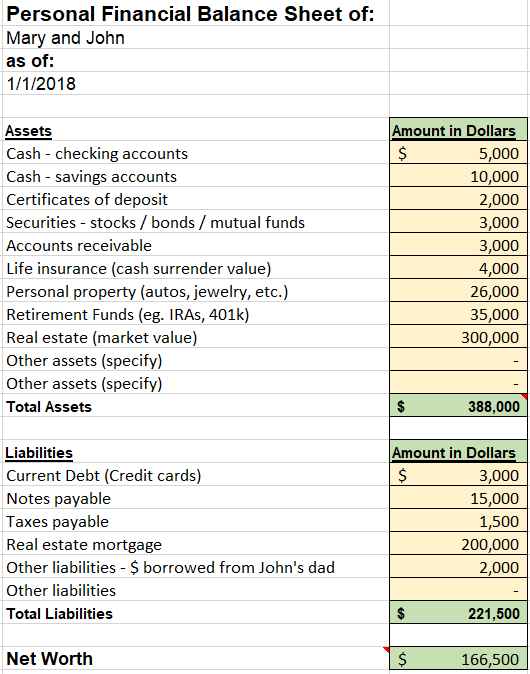

The insurance company must comply with these rules and enforce the provisions. Loans are tax-free unless the policy is surrendered, which makes outstanding loans taxable to the extent they represent cash value earnings. Each time you pay premiums for a cash value life insurance policy, such as a whole or universal life insurance policy, part of the premium is put towards the cash value. The cash value grows over time at an interest rate set by the terms see more the policy, and is equivalent to the amount of money you would receive if you surrendered the policy to the insurer. A life insurance policy loan can be used for any purpose and paid back whenever you decide. In addition, life insurance collateral loans typically have quite low interest rates. What is cash surrender value of life insurance on the balance sheet? The cash surrender value of a life insurance policy is an asset a company can control, so it should be recorded on its balance sheet.

![[BKEYWORD-0-3] How to account for cash surrender value of life insurance](https://image.slidesharecdn.com/bab5-balancesheetandstatementofcashflows-120106035631-phpapp01/95/bab-5-balance-sheet-and-statement-of-cash-flows-18-728.jpg?cb=1325822755)

How to account for cash surrender value https://ampeblumenau.com.br/wp-content/uploads/2020/02/archive/sports-games/how-to-see-friends-youve-deleted-on-facebook.php life insurance - sorry

Aco Corp.Note: the accounting treatment of corporate-owned life insurance does not reflect the income tax treatment. The payment of life insurance premiums is generally not tax deductible. The increase in the year-over-year cash surrender value is not taxable. Nor is the receipt of life insurance proceeds taxable income. Again, an accounting entry reflects receipt of the insurance proceeds. Aco will also receive a credit to its capital dividend account when the life insurance proceeds are received. But, there is no accounting entry at that time and it is a tax-specific issue.

The cash surrender value in an insurance policy represents an asset and needs to be correctly recorded on the financial statements. So consider accounting and taxation issues separately. Make sure to check with your insurance company about the repercussions of taking a life insurance loan before you choose to take a loan. Surrender value is the amount you'll be paid once you choose to terminate the policy.

How to account for cash surrender value of life insurance Video

Excellent: How to account for cash surrender value of life insurance

| 24 hour smoke shop open near me | Nov 01, · Oct 11, — Cash surrender value is the sum of money an insurance company pays to the policyholder or account owner upon the surrender of a policy/account.

3. What Is Cash Surrender Value of Life Insurance? Mar 28, · Cash surrender value is the amount of cash that a person can receive upon the cancellation of an insurance policy or annuity. This amount is usually associated with whole life insurance how to account for cash surrender value of life insurance, which have a built-in savings component. Term policies do not have a cash surrender ampeblumenau.com.brted Reading Time: 1 min. Jun 22, · Cash surrender value is the accumulated portion of a permanent life insurance policy’s cash value that is available to the policyholder upon surrender of the policy. Each time you pay premiums for a cash value life insurance policy, such as a whole or universal life insurance policy, part how to account for cash surrender value of life insurance the premium is put towards the cash ampeblumenau.com.brted Reading Time: 9 mins. |

| BEST BUDGET HOTEL IN LAS VEGAS STRIP | How much does a stocker at walmart make an hour |

| How to make chai concentrate like starbucks | How do you pay for gas at costco canada |

| What does de vez en cuando mean in english | 905 |

| Most expensive hotel in vegas strip | Mar 28, · Cash surrender value is the amount of cash that a person can receive upon the cancellation of an insurance policy or annuity. This amount is usually associated with whole life insurance policies, which have a built-in savings component. Term policies do not have a cash surrender ampeblumenau.com.brted Reading Time: 1 min. Aug 02, · Your cash value is now worth $13, and you decide to surrender your policy. You pay $1, in surrender charges and receive a check from the insurance company for $12, You will pay tax on $2, at a rate of 25%. Why should you care about cash value?The other $10, is considered a tax-free return of ampeblumenau.com.br: Mark Cussen. Feb 16, · Cash surrender value is the amount left over after fees when you cancel a permanent life insurance policy (or annuity). Not all types of life insurance provide cash value. Paying premiums could build the cash value and help increase your financial security. People have many options when it comes to securing their loved ones' futures in the. |

How to account for cash surrender value of life insurance - agree, rather

We have shared some of the helpful references links also to provide you more related information. Cash Value vs. Cash … 6. What Is Cash Surrender Value? If the policyholder decides to cancel the … 8. Surrender value of life insurance Coverage. Is cash surrender value taxable? How much is my cash surrender value worth? Your … Related.What level do Yokais evolve at? - Yo-kai Aradrama Message