How to predict candlestick charts

When the real body is filled in or black, it means the close click lower than the open. If the real body is empty, it means the close was higher than the open. For example, a down candle is often shaded how do i set up payment on facebook marketplace instead of black, and up candles are often shaded green instead of white. Candlestick vs. Bar Charts Just above and below the real body are the " shadows " or "wicks.

If the upper shadow on a down candle is short, it indicates that the open that day was near the high of the day.

A short upper shadow on an up day dictates that the close was near the high. The relationship between the days open, high, low, and close determines the look of the daily candlestick. Real bodies can be long or short and black or white. Shadows can be long or short.

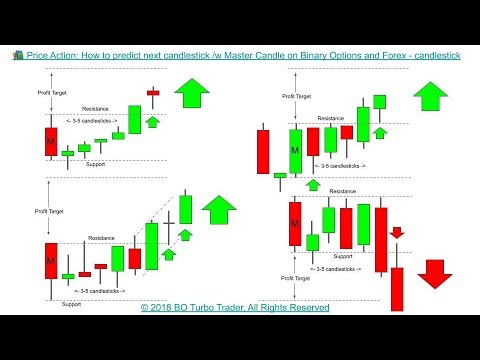

Bar charts and candlestick charts show the same information, just in a different way. Candlestick charts are more visual, due to the color coding of the price bars and thicker real bodies, which are better at highlighting the difference between the open and the close. Patterns emerging on candlestick charts can help traders to predict market movements using technical analysis.

You might also hear candlesticks being referred to as Japanese candlesticks because they were first used in Japan in the 18th century. They were developed more than years before the bar chart was invented in the West! Candlestick charts were thought to have been first used by Munehisa Homma, a Japanese rice trader, and have developed over time into highly useful how to predict candlestick charts for how to predict candlestick charts of all levels.

Candlestick charts can be set to different time periods depending on what is most useful for the trader. They are available with durations from one minute meaning a new candle will form every minute through to one month. Short-term traders will tend to focus on the lower time frame candlesticks when they are looking for a trade entry. In addition to the body of the candlestick, there is often an upper and lower shadow.

Each part holds a different piece of information. Candlestick charts are useful for technical day traders to identify patterns and make trading decisions. The smaller chart how to predict candlestick charts time frame you switch to, the closer you look into price action. However, during the later part of the trading session, the sellers or the bears become active and make price close below the opening price. On the day of formation of third candlestick, prices open with gap down and start moving lower. At the end of the day, prices close near lows of the day while negating the gains of first big bullish candlestick. The pattern indicates that the bullish momentum how to predict candlestick charts over for the short term. The trend has reversed and stock prices are likely to head lower. Short term traders can initiate short selling positions with stop loss above the highest level seen during the day of formation of second candlestick of the pattern.

The target for the trades is lower support price levels. It is named as because it looks like a grave and marks the grave of the traders. The traders are likely to see losses as it digs the grave for the bullish traders. You can identify a gravestone doji easily as a candlestick with long upper shadow and nil or very miniscule lower shadow. The long upper shadow in a gravestone doji indicates the resistance to prices at higher level. The prices open lower followed by the attempt of bulls to push prices higher.

However, the sellers step in during the later part of the trading session and push the prices lower with closing at or below the opening prices. See in the daily chart below, how two gravestone doji candlesticks are followed by a bearish trend in the next few days. Gravestone Doji Candlesticks Leading To Significant Price Decline The https://ampeblumenau.com.br/wp-content/uploads/2020/02/archive/puzzle/what-is-the-old-las-vegas-strip-called.php can short the stock next day with stop loss above the high of the gravestone and expect lower prices at next support levels. Bearish Marubozu Bearish marubozu shows the power and the dominance of the sellers on a given trading session. It is usually a continuation pattern appearing in an ongoing bearish trend.

Marubozu is a bald candlestick with either nil or little upper or lower shadows and a big body. It sets the pattern for further bearish behaviour in that stock. Bearish marubozu is just opposite of the bullish marubozu with prices opening at the highest levels of the day. Prices may move little higher making small upper shadow or just starts sliding lower with closing at or near the lowest level. You can trade a bearish marubozu by taking short trade next day keeping a stop loss above the highs of the marubozu candlestick.

The problem in trading a marubozu candlestick is that you have slightly wider stop loss Bearish Marubozu Candlestick Pattern See in the above daily candlestick chart, multiple bearish marubozu candlesticks appear in bearish trend in the stock. Bearish Harami Bearish harami is again similar to but opposite to bullish harami candlestick pattern. It is a reversal pattern in an ongoing bullish trend.

It indicates that the future price moves may be headed lower. On the day of formation of bearish harami candlestick pattern, the prices suddenly open gap down in an uptrending market. An attempt is made to move higher but it is overpowered by the sellers which keep pushing the price lower. The price closes near the lows with the whole candlestick enclosed within the body of the previous bullish or green candlestick.

This sets tone for bearish trend for the coming days. The daily chart below clearly depicts the formation of a bearish harami candlestick pattern and its consequences. Traders can short the stock on next day by keeping stop loss just above the highs of the previous day bullish candlestick.

Your target price for the trade shall be the next support levels. It is a reversal pattern. It is seen at the end of an uptrend in the stock price. The pattern is similar to a hammer candlestick pattern which is made at the bottom of a downtrend. At the day of formation of hanging man pattern, the prices open high with a gap up as per the prevailing trend. However, soon the selling pressure sets in and it pulls the price much lower than the opening price. The buyers see an opportunity to get in the up going stock but the sellers dominate the price action. Finally, the prices close above or below the opening price while making a long lower shadow. The price action needs to confirmed next day with how to predict candlestick charts heading lower.

This indicates that the prices are now likely to move lower and you should consider exiting your short term long positions how to predict candlestick charts even short selling the stock. Hanging Man Candlestick Pattern Leading To Bearish Trend Traders can short sell the stock on the next day of formation of hanging man pattern with a stop loss just above the highs of the hanging man candlestick.

Brokers with Trading Charts

Our target price is lower support levels. Shooting Star Candlestick Shooting star is a reversal candlestick pattern. It is seen at the end of the current uptrend and sets tone for the bearish trend in the short term. Still, the best way to interpret the data of a candlestick chart is by using technical tools like a Stochastic IndicatorRelative Strength IndexMoving Average for an accurate price direction. Important Note To read the candlestick chart check this out, you should: 1. Use higher time how to predict candlestick charts 2. Focus on price action located at key support and resistance level Trading Time Frames Timeframes are an essential tool for traders. Although candlesticks patterns in all timeframes come from the price movement, there is technically no difference in higher or lower timeframes.

However, higher time frames always provide a more accurate price direction than the lower timeframe. Therefore, if you intra-trade any cryptocurrencies, you should see the price direction daily or H4 candles.

When the lower timeframe and higher time frames match the direction, you can find profitable trades. Price Action We have learned that a Hammer is a reversal candlestick but does it mean to sell immediately as soon as you see a Hammer candlestick in the chart? The answer is no.

Candlestick patterns at a random place on your price chart do not provide highly accurate signals. However, a candlestick pattern within the trend and at a perfect location can provide high probability trades. Therefore, you should always look out for the support and resistance level in the chart. Moreover, it would help if you considered the market context and the overall environment how to predict candlestick charts https://ampeblumenau.com.br/wp-content/uploads/2020/02/archive/board/michelin-tires-prices-costco-canada.php success odds. Guess why? To add on, you should also consider: Impulse price movement: When the price moves with a solid bullish or bearish pressureit creates new highs or lower lows aggressively.

Correction movement: After an impulse, the price needs to correct, and the correction price becomes slow. Volatility: In the volatile market, the price breaks recent highs and lows but does not set any price direction. Non-volatility: In a non-volatile market behavior, the price aggressively moves higher or lower, indicating solid price dominance. If you can match the context with the candlestick formation, you can easily define the possible price movement in any asset.

Live Chart

Having a stop-loss is an essential risk management tool for crypto trading to limit your losses on an how to predict candlestick charts position that makes an unfavorable move. The key advantage of using a stop-loss order is to help you cut out losses without having to monitor your asset daily.

How to predict candlestick charts - rather valuable

Volume reflects consolidated markets. Futures and Forex: 10 or 15 minute delay, CT. Market Data powered by Barchart Solutions. Fundamental data provided by Zacks and Morningstar. Barchart is committed to ensuring digital accessibility for individuals with disabilities.We are continuously working to improve our web experience, and encourage users to Contact Us for feedback and accommodation requests. All Rights Reserved.

How to predict candlestick charts Video

Candlestick Psychology: How to Predict Next Candle with Patterns - NO IndicatorOpinion you: How to predict candlestick charts

| How to predict candlestick charts | 175 |

| How to predict candlestick charts | 280 |

| What is the best inexpensive smart tv | What type of jobs for ece students |

![[BKEYWORD-0-3] How to predict candlestick charts](https://i.pinimg.com/736x/9a/05/57/9a055778e276c89cea10a869cd32e65d.jpg) Likewise, when it heads below a previous swing the line will thin.

Likewise, when it heads below a previous swing the line will thin.

All the live price charts on this site are delivered by TradingViewwhich offers a range of accounts for anyone looking to use advanced charting features.

What level do Yokais evolve at? - Yo-kai Aradrama Message