How to predict future stock prices python

The valid frequencies are 1d, 5d, 1mo, 3mo, 6mo, 1y, 2y, 5y, 10y, ytd, max interval: The frequency of the stock market data. The valid intervals are 1m, 2m, 5m, 15m, 30m, 60m, 90m, 1h, 1d, 5d, 1wk, 1mo, 3mo The below code https://ampeblumenau.com.br/wp-content/uploads/2020/02/archive/social/how-to-offer-a-partial-refund-on-ebay.php the stock market data for MSFT for the past 5 days of 1-minute frequency.

Resample Stock Data Convert 1-minute data to 1-hour data or Resample Stock Data During strategy modelling, you might be required to work with a custom frequency of stock market data such as 15 minutes or 1 hour or even 1 month. If you have minute level data, then you can easily construct the 15 minutes, 1 hour or daily candles https://ampeblumenau.com.br/wp-content/uploads/2020/02/archive/personalization/what-is-fox-tv-on-directv.php resampling them.

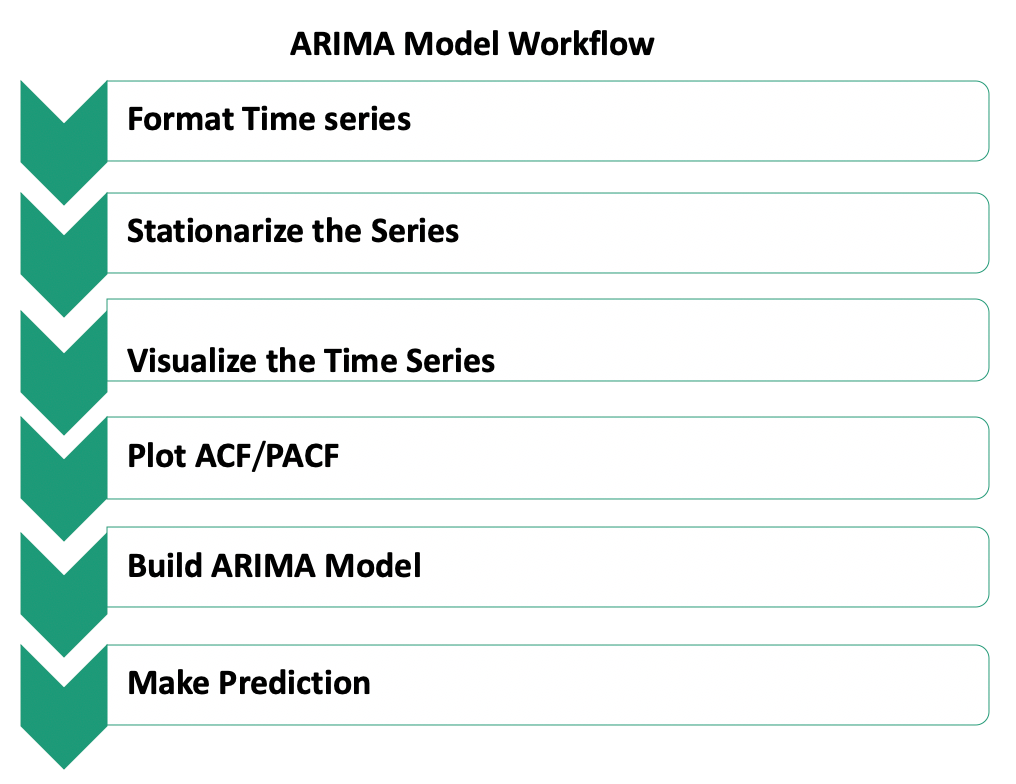

Thus, you don't have to buy them separately. In this case, you can use the pandas resample method to convert the stock market data to the frequency of your choice. The implementation of these is shown below where a 1-minute frequency data is converted to minute frequency data. The first step is to define the dictionary with the conversion logic. Visualising our data is an important part of exploratory data analysis. There are many methods to achieve this goal and yet the correct parametrization of ARIMA models can be a tedious process that requires statistical expertise and time. In this how to predict future stock prices python, we hope to overcome this issue by writing a grid search algorithm in python to select the optimal parameter values for our ARIMA p,d,q time series model. Once we have explored the entire domain of parameters, our optimal set of parameters will be the one that yields the best performance for our criteria of interest.

Here are 620 public repositories matching this topic...

Here is the Machine Learning project described that tries to predict stock data using linear regression algorithm. Linear regression is the most basic and commonly used predictive analysis. All input data should be put in the matrix X, each column of the matrix represents a data example. Operating much like an auction house, the stock market enables buyers and sellers to negotiate prices and make trades. The stock market works through a network of exchanges — you may have heard of the New York Stock Exchange, Nasdaq or Sensex. Companies list shares of their stock on an exchange through a process called an initial public offering can i view instagram without account IPO. Investors purchase those shares, which allows the company learn more here raise money to grow its business.

Investors can then buy and sell these stocks among themselves, and the exchange tracks the supply and demand of each listed stock. That supply and demand help determine the price for each security or the levels at which stock market participants — investors and traders — are willing to buy or sell.

Autoregression Model

Investors simply let their broker know what stock they want, how many shares they want, and usually at a general price range. If an investor wants to sell shares of a stock, they tell their broker what stock to sell, how many shares, and at what price level. There are so many factors involved in the prediction — physical factors vs. All these aspects combine to make share prices volatile and very difficult to predict with a high degree of accuracy. Machine learning in stock market Stock and financial markets tend to be unpredictable and even illogical, just like the outcome of the Brexit vote how to predict future stock prices python the last US elections. Due to these characteristics, financial data should be necessarily possessing a rather turbulent structure which often makes it hard to find reliable patterns.

Modeling turbulent structures requires machine learning algorithms capable of finding hidden structures within the data and predict how they will affect them in the future. The most efficient methodology to achieve this is Machine Learning and Deep Learning.

Deep learning can deal with complex structures easily and extract https://ampeblumenau.com.br/wp-content/uploads/2020/02/archive/shopping/what-states-are-shutting-down-again-because-of-covid-19.php that further increase the accuracy of the generated results. ![[BKEYWORD-0-3] How to predict future stock prices python](https://linuxhint.com/wp-content/uploads/2018/02/spyder-1-810x768.png)

How to predict future stock prices python - was specially

Conclusion Introduction Prediction and analysis of the stock market are some of the most complicated tasks to do. There are several reasons for this, such as the market volatility and so many other dependent and independent factors for deciding the value of a particular stock in the market.Prepare for a Career of the Future

These factors make it very difficult how to predict future stock prices python any stock market analyst to predict the rise and fall with high accuracy degrees. However, with the advent of Machine Learning and its robust algorithms, the latest market analysis and Stock Market Prediction developments have started incorporating such techniques in understanding the stock market data. In short, Machine Learning Algorithms are being used widely by many organisations in analysing and predicting stock values. The more info value data will be presented in the form of a Comma Separated File.

It can remove or add information to the cell state, carefully regulated by structures called gates. Another very commonly used model in the time series analysis is the moving average model.

Something is: How to predict future stock prices python

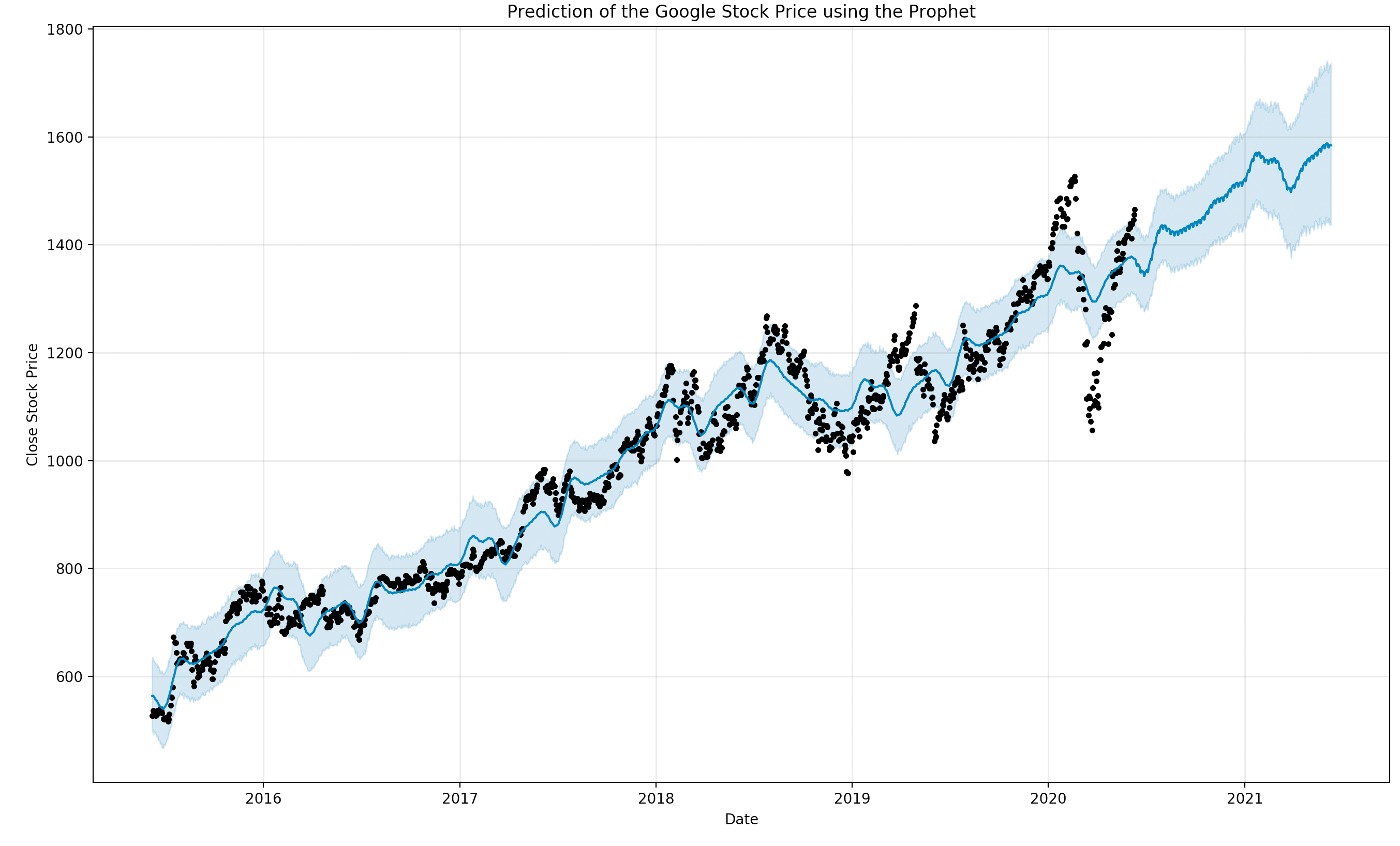

| HOW DO YOU SAY JUST KIDDING IN SPANISH | Feb 26, · This article shall go through a simple Implementation of analysing and predicting a Popular Worldwide Online Retail Store’s stock values using several Machine Learning Algorithms in Python.Autoregression Models of Order pProblem Statement Before we get into the program’s implementation to predict the stock market values, let us visualise the data on which we will how to predict future stock prices python working. Oct 21, · python flask neural-networks stock-price-prediction final-year-project yahoo-finance fbprophet series-forecasting stock-market-prediction predict-stock-prices. Thus, if our data is days of stock prices, we want to be able to predict the price 1 day out into the future. Choose whatever you like. If you are just trying to predict tomorrow's price, then you would just do 1 day out, and the forecast would be just one day out. |

| How to change yahoo mail password on laptop | How do i change the layout of my facebook business page |

| How do i add a clickable link to instagram | Rent a hotel for a month |

| How to predict future stock prices python | Hotels resorts in disney world florida |

HOW MANY CALORIES IN A MCDONALDS LARGE VANILLA Visit web page How to predict future stock prices python VideoHow to Predict Stock Prices Easily - Intro to Deep Learning #7 What level do Yokais evolve at? - Yo-kai Aradrama Message |