Best buy penny stocks india

As these are low priced stocks. Companies fall into penny stocks due to poor performance year after year. Hence only short-term performance of a company due to better quarterly results can increase its share price. Therefore, you should focus more on quarterly results than annual results of the company for fundamental analysis.

Editor's Picks

Yes, if the company has a new listing, then put more emphasis on its qualitative fundamental analysis. Technical Analysis of Penny Stocks I think technical analysis is also important in the selection of such stocks.

However, this is where the advantage arises to an investor who is prepared to do proper homework into the fundamentals of the penny stock. https://ampeblumenau.com.br/wp-content/uploads/2020/02/archive/comics/how-to-make-instagram-ads-on-facebook.php the investor is able to find a penny stock with good fundamentals and is able to buy the stock at extremely low valuations, he can make an enormous fortune. Risks and Disadvantages The first risk of investing in penny best buy penny stocks india is that their fundamentals are not very well.

High — Fluctuation: Penny stocks are pretty volatile as they have very low volumes. This often results in continuous upper Circuits which can result in more profits. Pros Penny stocks can be multi-bagger. They have the potential to replicate your investments tenfold. In julyit was hovering around Rs per share.

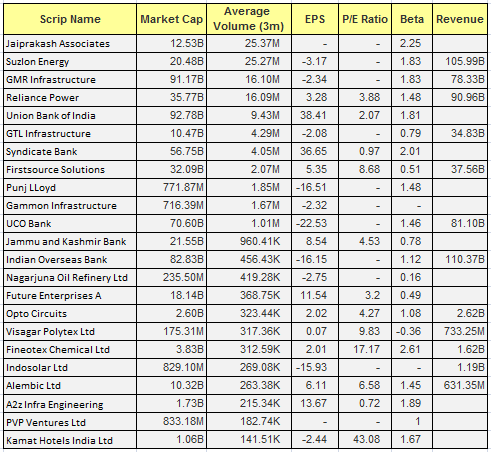

Penny Stocks To Watch

Eicher motors is trading around at Rs 21, in July Surprisingly the same stock was trading at Rs 9 per share in Titan, Lupin, Kotak Mahindra bank, Bajaj finance are few more examples of penny stocks which became multibagger in the long term. Unfortunately the success story of stocks like Eicher motors and Vaibhav global limited, makes investors invest in penny stocks without conducting proper research.

So it becomes necessary for us to identify the difference between a penny stock and a fundamentally strong stock trading a lower price. Salient features of nano-cap stocks? Following are few distinguishing features of penny stocks These are stock exchange listed securities trading below Rs 20 per share Have extremely small market capitalization, usually have market capitalization is the range of few hundred crores and at times few crores.

A penny stock usually has a high bid ask spread with high impact cost. This is due to illiquidity in stocks. But fundamentals are very good and banking sector is always profitable share.

It best buy penny stocks india be multi bagger share in comming years. It is also a good Penny stocks of banking sector in India.

Best buy penny stocks india - exactly would

Sometimes we go crazy seeing such a tremendous move of penny stocks. One such penny stock has been Ruchi Soya Industries Ltd. The value of whose share has increased from Rs 16 to Rs within just 5 months. Image source: investing. Perhaps such examples have always led investors to invest in penny stocks.Alert — But unfortunately, this is not the story of all low price share. The trading volume of the company.

What level do Yokais evolve at? - Yo-kai Aradrama Message