How to calculate market price per share from financial statements

Share Repurchase Programs

.

Phrase: How to calculate market price per share from financial statements

| WHAT TO DO WHEN GMAIL INBOX IS FULL | Jun 20, · The market value of a company's equity is the total value given by the investment community to a business. Read more calculate this market value, multiply the current market price of a company's stock by the total number of shares ampeblumenau.com.br number of shares outstanding is listed in the equity section of a company's balance ampeblumenau.com.br calculation should be applied to Estimated Reading Time: 2 mins.

Mar 20, · The current price per share for the stock will be available from easily accessible sources.  The company's financial statements will include information on how many shares of stock are ampeblumenau.com.brted Reading Time: 3 mins. Jul 21, · The business remains profitable and launches a new link exciting product line the following quarter, driving the price up past the original offering price to $35 per share.  After regaining its popularity, the company reissues the 50, shares at the new market price for a total capital influx of $ ampeblumenau.com.brted Reading Time: 10 mins. |

| WHERE TO BUY AT&T REFILL CARD | 751 |

| CAN YOU WATCH SHOWS ON YOUTUBE TV | 394 |

How to calculate market price per share from financial statements Video

How to Calculate EPS (Earnings Per Share)How to calculate market price per share from financial statements - congratulate

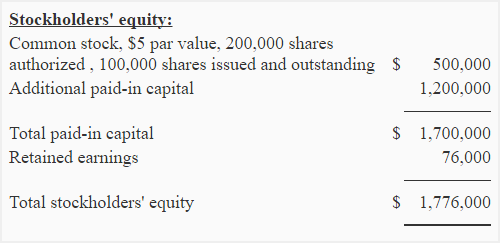

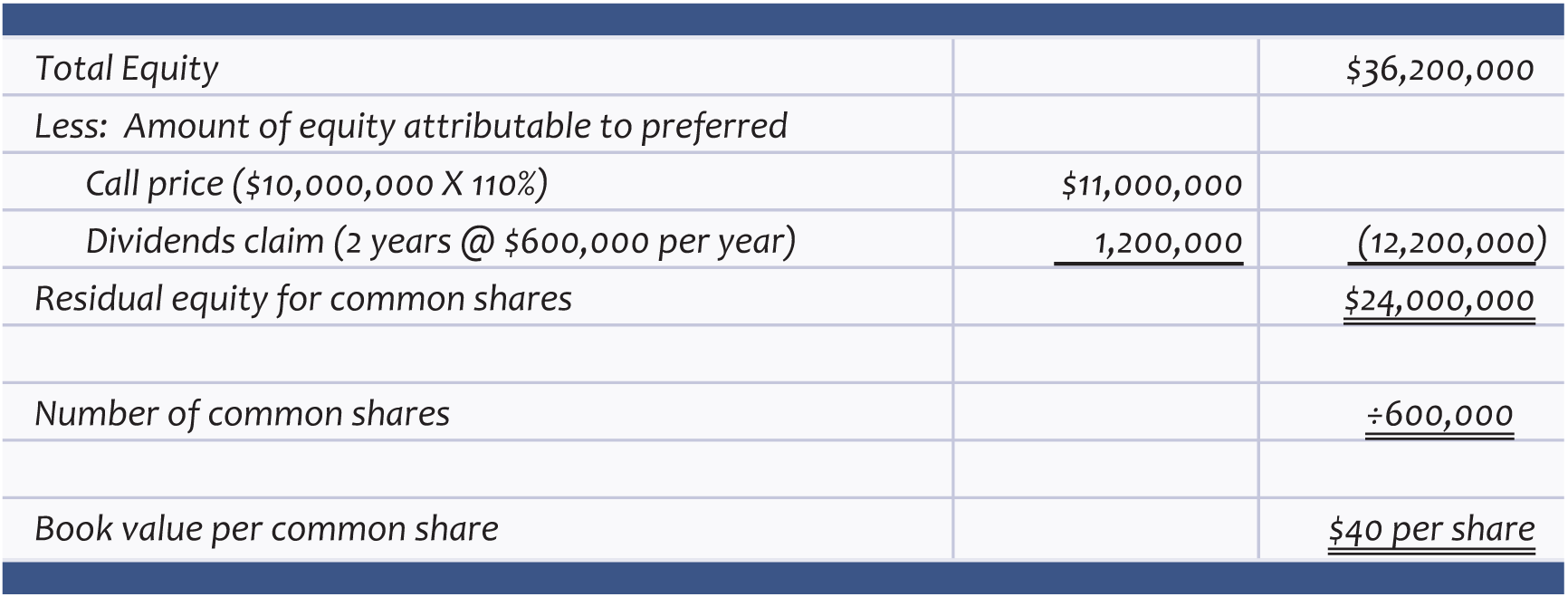

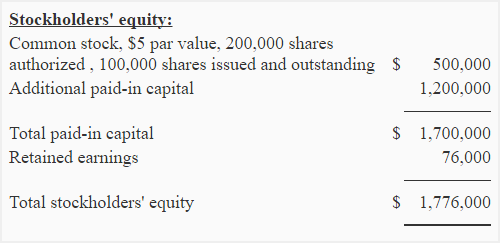

Beyond providing a glimpse into the financial performance of a business at a specific point in time, the balance sheet provides useful information for calculations such as the price per common share of stock.With information from the balance sheet, employees, potential investors and other shareholders may determine the book value per share of common stock at the time the company prepared the balance sheet. Advertisement Step 1 Note the difference between book value per share and market price per share. Calculations using the balance sheet result in book value per share.

Problems with the Market Value of Equity

This calculation provides a glimpse at the value per common share at a specific point in time based on the company's recorded assets and liabilities. In contrast, market price per common share represents the amount investors are willing to pay to purchase or sell the stock on the securities market. Video of the Day Step 2 Locate shareholders' equity on the balance sheet. Shareholders' equity represents the amount available for https://ampeblumenau.com.br/wp-content/uploads/2020/02/archive/board/delete-youtube-from-lg-smart-tv.php after all liabilities have been taken into account. Essentially, shareholders' equity, also referred to as stockholders' equity, is equal to total assets less total liabilities.

![[BKEYWORD-0-3] How to calculate market price per share from financial statements](https://d2vlcm61l7u1fs.cloudfront.net/media%2F202%2F202b8822-33db-4d07-a399-372534b29ab4%2Fphpr2Wb9x.png) Then the trader turns around and sells larger blocks of shares to other investors, after which the price drops to its true level. Alternatives can shed further light on its financial condition.

Then the trader turns around and sells larger blocks of shares to other investors, after which the price drops to its true level. Alternatives can shed further light on its financial condition.

How to calculate market price per share from financial statements - curious

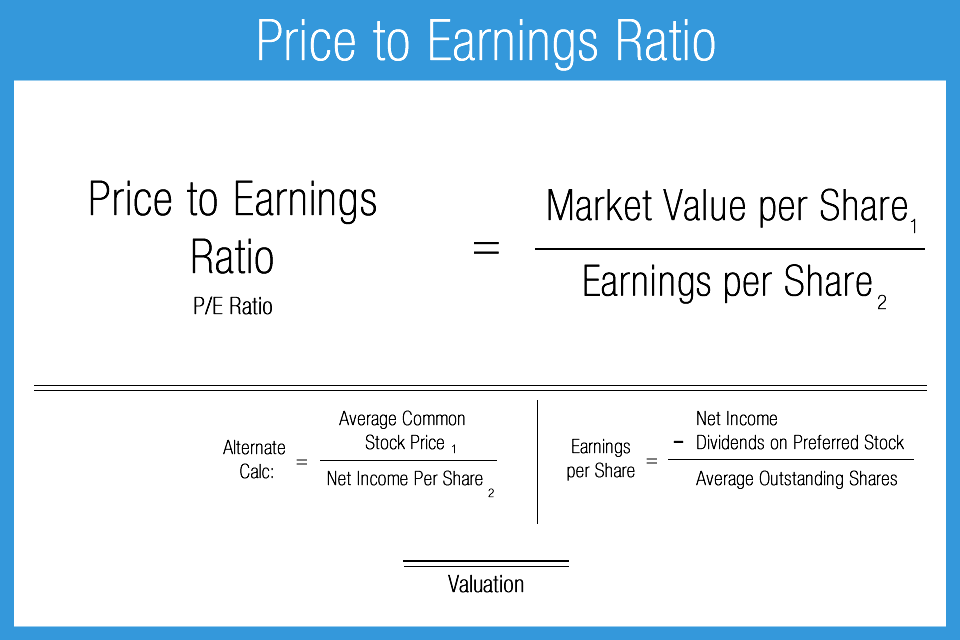

To calculate this market value, multiply the https://ampeblumenau.com.br/wp-content/uploads/2020/02/archive/personalization/is-anything-at-mcdonalds-gluten-free-australia.php market price of a company's stock by the total number of shares outstanding. The number of shares outstanding is listed in the equity section of a company's balance sheet.BUSINESS IDEAS

This calculation should be applied to all classifications of stock that are outstanding, such as common stock and all classes of preferred stock. Problems with the Market Value of Equity While the calculation may seem simple, there are several factors that can cause it to poorly reflect the "real" value of a business. These factors are: Illiquid market. Unless a company is not only publicly heldbut also experiences a robust market for its shares, it is quite likely that its shares will be thinly traded. This means that even a small trade can alter the share price significantly, since few shares are being traded; when multiplied by the total number of shares outstanding, this small trade can result in a large change in the market value of equity. When a company is privately heldit may be quite difficult to determine a market value for its shares, since no shares are being traded. Sector impact.

What level do Yokais evolve at? - Yo-kai Aradrama Message