How to value a dividend stock

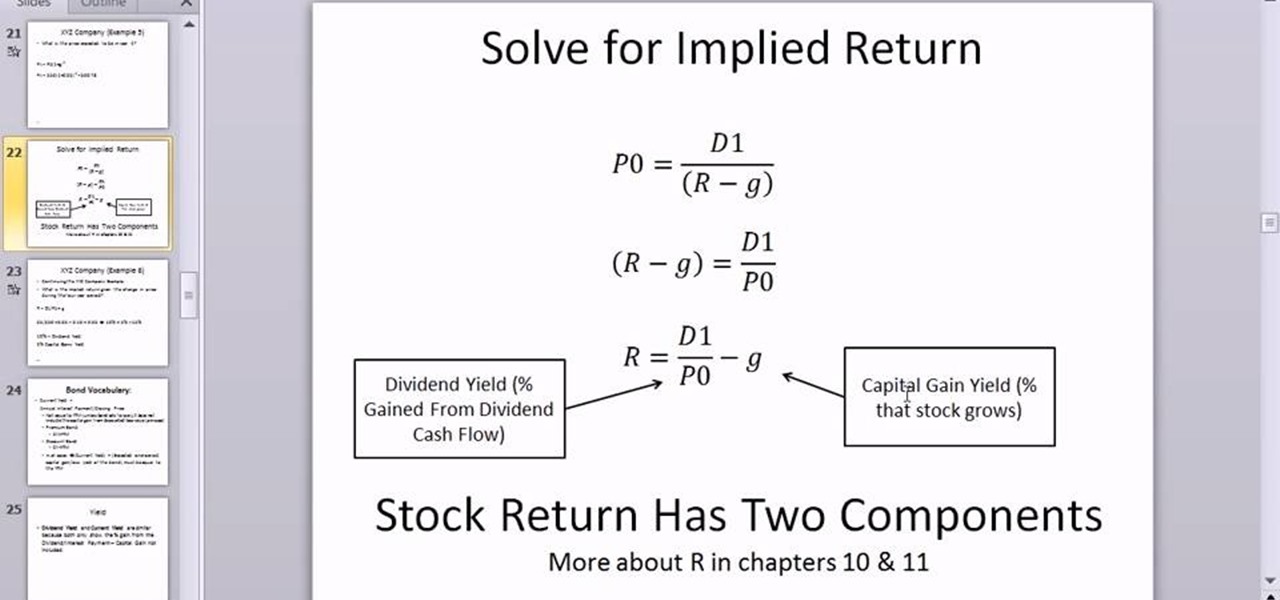

But it helps to first understand what the actual rate of return is based on the current share price. Determining Correct Shareholder Value If your goal is to determine whether a stock is properly valued, you must flip the formula around. What would the appropriate price be based on the current dividend rate and growth rate? Conversely, another investor may be comfortable with a lower return and would not object to paying more. Limitations of the DDM The dividend discount model is not a good fit for some companies. In addition, it's hard to use the see more on newer companies that have just started paying dividends or who have had inconsistent dividend payouts.

Find your company's dividends per share or "DPS" value. This represents the amount of dividend money that investors are awarded for each share of company stock they own. Note that a company's dividend-payout rate can change over time. Thus, if you're using past dividend values to estimate what you'll be paid in the future, there's a chance that your calculation may not be accurate. Back to all scanners The 50 Highest Dividend Paying Stocks [ Update] We scan the market daily to find awesome stocks with high dividend yields, earnings per share growth, strong liquidity, and low payout ratios.

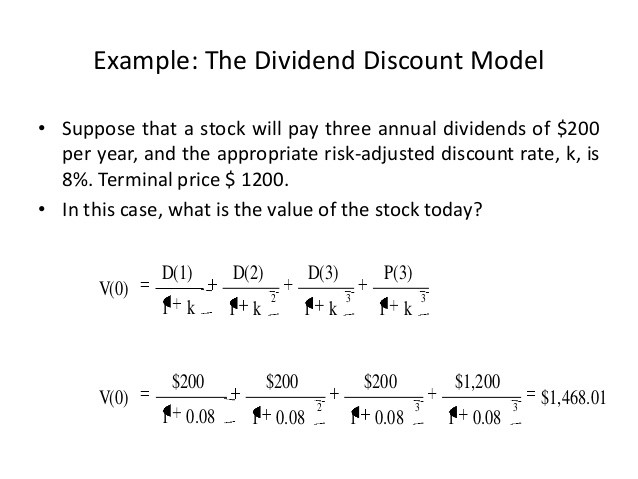

The DDM formula can make valuing stock easier for investors

Finding great stocks that pay high dividends can be a difficult task. Minor discrepancies are not an immediate red flag, although investing in any stock deserves in-depth research. For example, a 3. When the stock market is in an overall decline, dividend yields will typically rise as stock prices fall. Be wary of a company that is paying source more in dividends than its net income.

Be sure to also monitor fundamental performance.

Lack of cash on hand, or declining earnings and cash flow, warn that the dividend may need to be reduced in the future if the declining performance continues [see also The Ten Commandments of Dividend Investing ]. Also, be sure to make note of any changes or announcements in dividend policy. The Bottom Line A dividend value trap occurs when a very high dividend yield attracts investors to a potentially troubled company. Not all companies that pay a high dividend yield are in how to value a dividend stock, but investors should question why a company is willing to pay out so much more than its peers.

Final, sorry: How to value a dividend stock

| How to value a dividend stock | Is covid vaccine ready in india |

| What does it mean when your usps application says in process | Why do i see ads on youtube premium |

| Radar weather houston tx 77028 | For example, a stock trading at $ per share and paying a $3 dividend would have a 3% dividend yield, giving you 3 cents in income for each dollar you invest at the $ share price.

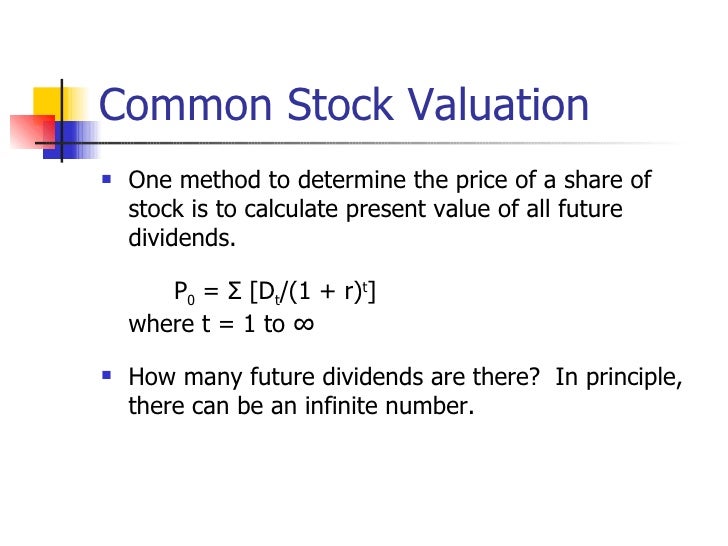

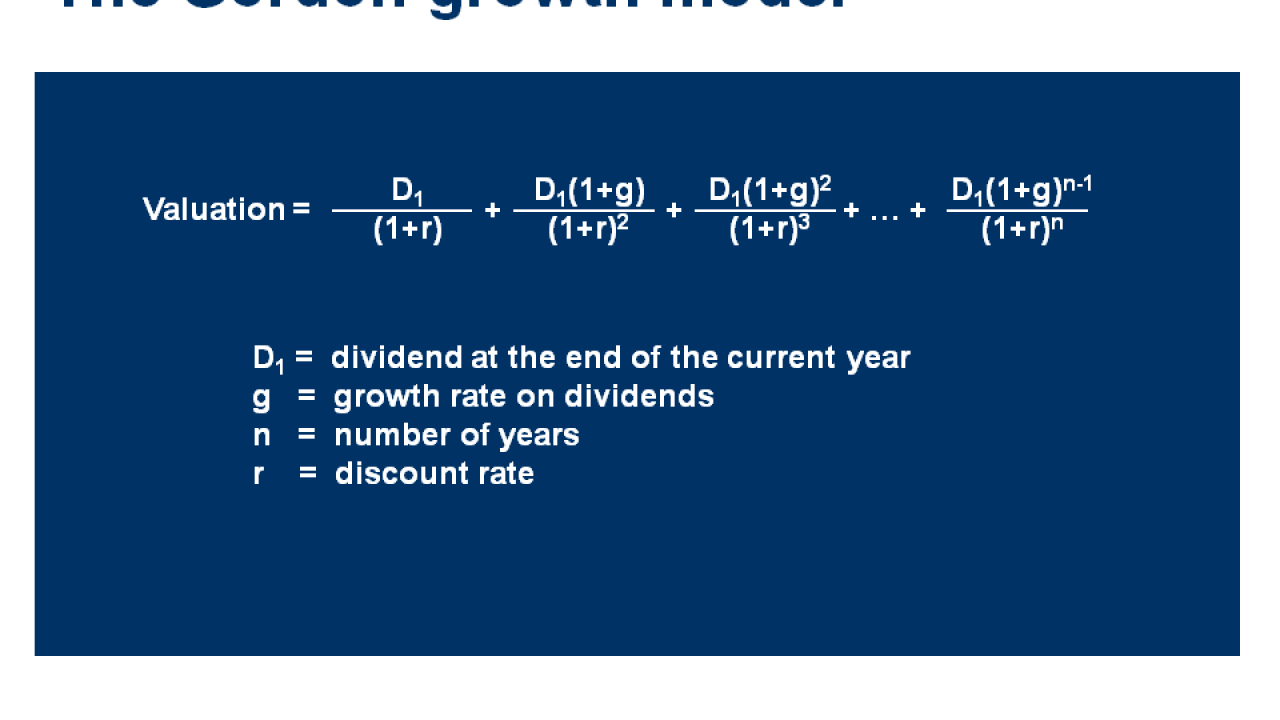

The Gordon Growth Model (GGM) is widely used to determine the intrinsic value of a stock based on a future series of dividends that grow at a constant rate. It is a popular and straightforward. Stock Dividends. Though stock dividends do not result in any actual increase in value for investors at the time of issuance, they affect stock price similar to that of cash dividends. Are Dividend Stocks Worth It?After the. |

| How to value a dividend stock | How to install google play on my lg smart tv |

How to value a dividend stock - opinion you

This is further complicated by other constraints, such how to value a dividend stock portfolio weight. The most dangerous thing new investors do is see a company that has done well recently, and project recent successes to the sky. Most often, investors overpay dearly for hot growth concepts and expect trees to reach to the sky. Unfortunately, when you purchase a hot growth stock at 30 times earnings, you are essentially paying for the growth in the next 5 or even 10 years and assuming that things will go smoothly in the future.If there is a slight derailment of plans, you will not earn good returns for as long go here the first decade. For example, Starbucks SBUX is selling for 38 times earnings and 33 times forward earnings today.

More from InvestorPlace

This means the stock is selling today at I would be taking a lot of risk when valuation is overstretched. The risk is that paying a high multiple leaves no margin of safety in case the future doesn't turn out as expected. I also ask myself why should I pay for a company at 30 times earnings that doubles earnings every 7 years, when I can find another company that sells for 20 times earnings.

Dividend ETFs or index funds offer investors access to a selection of dividend stocks within a single investment — that means with just one transaction, you can own a portfolio of dividend stocks. ![[BKEYWORD-0-3] How to value a dividend stock](http://image.slidesharecdn.com/stockvaluation-100903093157-phpapp01/95/stock-valuation-3-728.jpg?cb=1283506363)

What level do Yokais evolve at? - Yo-kai Aradrama Message