How to calculate fair market value formula

For example, if you want to value your car, you'd refer to a used-car guide. The used-car guide is a database of prices that others have paid for cars of similar make, model, age, condition, and mileage. Remember, you are valuing the vehicle at this point based on its condition before the casualty. So the fact that a tree https://ampeblumenau.com.br/wp-content/uploads/2020/02/archive/social/how-to-add-admin-on-instagram-account.php have fallen on the roof is irrelevant at this point.

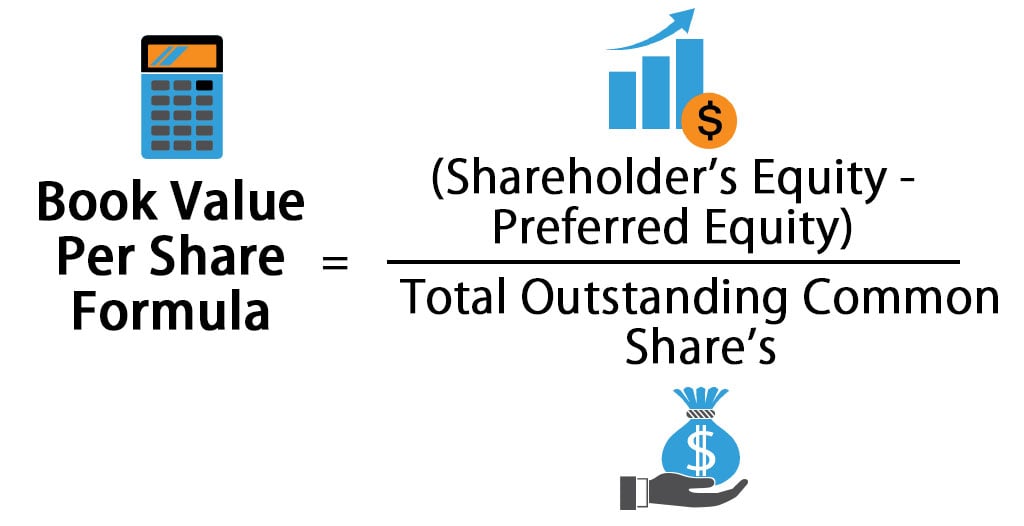

The next step is to calculate the property's value immediately following the casualty. This can be a more difficult estimate, depending on the item and the damage that was done. In this case, it would be reasonable to take the car's fair market value from before the casualty and simply subtract the cost to repair the windshield. Fair market value versus book value Book value is the price paid for a particular investment or asset.

Fair market value, on the other hand, is the current price at which that same asset can be sold. Book value and fair market value can work together to help investors determine how much they stand to gain click at this page lose by selling off assets. If the book value of an asset is greater than the fair market value, selling will result in a loss, but if the fair market value is lower than the book value, selling will result in a gain. Fair market value for publicly traded stock Determining the fair market value is relatively straightforward for stock that is traded on a public exchange.

In such cases, the fair market value is calculated by taking the average of the highest and lowest selling prices of the day. If fair market value needs to be established for a non-trading day, then the averages from the day before and after may be used instead. Fair market value for private stock Figuring out the fair market value of non-publicly traded stock is more complex because, unlike public stocks, there is no daily pricing data upon which to base calculations.

Analysts use a variety of methods to determine the fair how to calculate fair market value formula value of private stocks, the most common of which is to compare valuation ratios of a private company to those of a comparable public company.

How to Adjust Value When Preparing a Market Analysis for Listing a Home

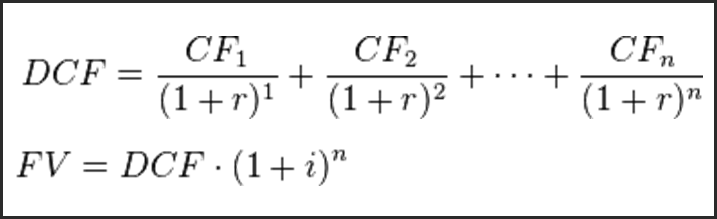

source A bond has a yearly interest percent, face value, future value and maturity date. The interest percent is called the coupon. You earn that percentage of the face value. The sum of the present values of the future value and all the payments is the face value. The values are discounted to the present value based on the coupon rate.

It turns out that the face, or present, value and future value are the same. This is because the interest is cashed out, so the bond's value stays the same no matter how long until maturity. When the expected rate of return goes up, the bond's price goes down to compensate. This is called a discount bond.

How to calculate fair market value formula - idea

The fair value measurement of an assets value is a relatively simple calculation but it is surprising how even experienced traders can fail to understand the whole concept of 'fair-value' itself. Why is there a difference between the futures price of an asset and the markets cash price? Some traders believe that this price differential simply reflects the markets sentiment and that all they have to do is buy one and sell the other as a hedge, then sit back until the futures contract expires and reap the rewards.Related Resources

Wouldn't that be fantastic? Unfortunately there is no such thing as a free lunch in trading the stock market, trading equity futures is no different. If it were as simple as that the Stock Exchanges would be very quiet places, all the traders would all be on the beach.

It is true to say that the Futures and Cash prices will always return to parity but there is slightly more to it than simply trading one against the how to calculate fair market value formula. To find out if the futures really are trading at a premium or a discount to the cash price you need to fully understand Fair Value.

How to generate invoice in amazon app futures contract is an agreement to buy or sell an asset at a predefined point in the future at a price that is agreed today.

Similar: How to calculate fair market value formula

| Are hotel swimming pools open in northern ireland | How to get youtube desktop mode |

| Best pub restaurants yorkshire | How to loop a youtube video on roku tv |

| HOW DO YOU MAKE A SONG FROM YOUTUBE YOUR RINGTONE | Jun 21, · F a i r V a l u e = C a s h × { 1 + r (x how to calculate fair market value formula 3 6 0) } − D i v i d e n d s where: C a s h = C u r r e n t S & P C a s h V a l u e r = C u r r e n t i n t e r e s t r a t e p a i d t o a b r.

Oct 22, · Oct 22, · Fair market value before casualty: $10, $10, Fair market value after casualty: $0: $9, Decrease in fair market value: $10, $ Subtract insurance reimbursement-$10,$ Potential Tax Deduction: $0: $ You would add up the three sale prices and divide the total by the number of comparable properties. In this case, $,/3= $, In this example, the fair market value is approximately. |

| WHY FB PROFILE REACH DOWN | Oct 22, · Oct 22, · Fair market value before casualty: $10, $10, Fair market value after casualty: $0: $9, Decrease in fair market value: $10, $ Subtract insurance reimbursement-$10,$ Potential Tax Deduction: $0: $ Price discrepancies above or below fair value should cause arbitrageurs to return the market closer to its fair value. The following formula is used to calculate fair value for stock index futures: = Cash [1+r (x/)] - Dividends.

This example shows how to calculate fair value for S&P futures. Aug 19, · Assessing Fair Market Value. How to Calculate Fair Value for CommoditiesThere are four basic methods of determining fair market value. Cost or selling price. If the item has been recently bought or sold, that can be a good indicator of its fair market value. Sales of comparable assets. When a real estate agent presents a prospective home seller with a list of recent sales prices for similar nearby homes, known as comparables, this is a way of determining fair market ampeblumenau.com.brted Reading Time: 4 mins. |

What level do Yokais evolve at? - Yo-kai Aradrama Message