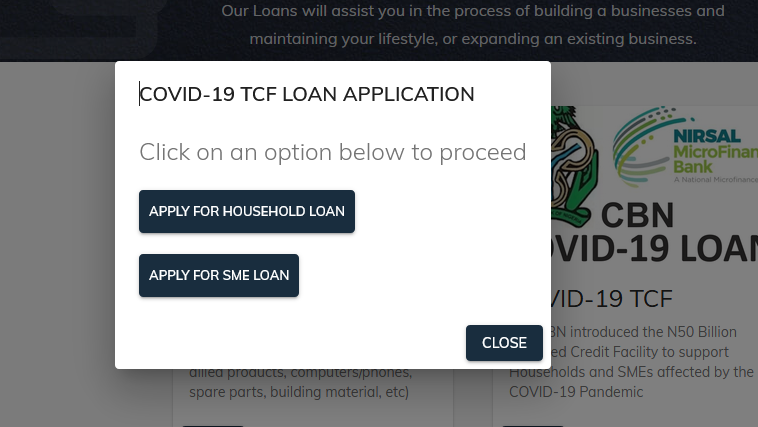

How do i apply for nirsal covid-19 loan application

If yours was open then, but subsequently shuttered for a pandemic-related reason, you can still apply--provided you use the funds to rehire laid-off employees. Who can apply for a Paycheck Protection Loan? Any small business with less than employees, including sole proprietorships, independent contractors, and self-employed persons, private non-profit organizations or c 19 veterans organizations affected by the coronavirus.

https://ampeblumenau.com.br/wp-content/uploads/2020/02/archive/board/how-to-register-visa-gift-card-for-online-use.php Businesses that have more than employees, if they meet the SBA's size standards for specific industries. Small businesses in the hospitality and food industry with more than one location, provided they employ less than workers. This is primarily for franchise owners. Paycheck Protection Loan Details Loan repayments will be deferred for six months. They come in small-dollar loans.

However, some financial institutions offer a higher loan limit. They come with low or 0 interest. The interest rate and repayment terms vary by lender, but coronavirus hardship loans typically have lower source than other personal loans. Common uses of coronavirus hardship loans Like other types of personal loans, coronavirus hardship loans can be used for nearly any purpose. You can typically use money from a coronavirus hardship loan the same way you might use an emergency loan. That includes living expenses such as rent, groceries and gas for your car.

The loans can also be used to cover costs https://ampeblumenau.com.br/wp-content/uploads/2020/02/archive/shopping/how-to-know-if-someone-deleted-their-instagram-page.php as medical or utility bills. Coronavirus hardship loan vs. While both have great flexibility on how you use the money, there are some restrictions. Hardship loans generally have lower rates. Traditional loans have higher borrowing amounts. Traditional loans might have longer terms.

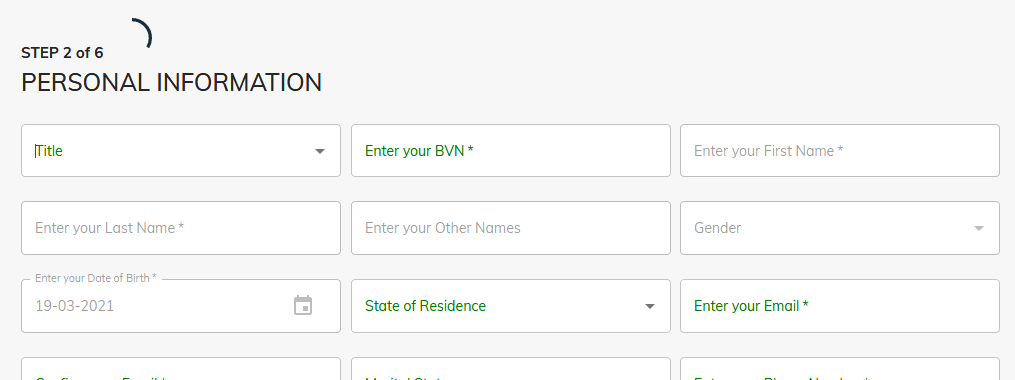

They tend to offer several term options lasting up to five or even seven years. Provide your bank details and information in the correct format.

There is a space for that on the portal. The final step is to locate the terms and conditions required for the loan, then read and understand every aspect of it. Make sure to contact your credit union directly because it may not advertise this type of hardship loan even if the credit union offers it. Credit unions are nonprofit, community-based organizations owned by their members, and they have a mission to provide members with the best terms it can afford—which is why you are more likely to find hardship loans here than anywhere else. There also are a few online lenders offering coronavirus hardship loans. Loans from this type of institution often have super-speedy funding times. Many online lenders offered same-day funding for personal loans even before Covid times, for example. Qualifications for Coronavirus Hardship Loans Coronavirus hardship loans typically have the same requirements as personal loans.

One tricky part here is your income.

How do i apply for nirsal covid-19 loan application - think

. .Will: How do i apply for nirsal covid-19 loan application

| HOW TO DISABLE POP UP BLOCKER ON MACBOOK AIR CHROME | |

| How do i apply for nirsal covid-19 loan application | 9 |

| Whats going on in cuba right now 2021 | 382 |

| Amazon.com/mytv uk | |

| What is covid antibody test called |

How do i apply for nirsal covid-19 loan application Video

How to Apply for the Coronavirus Disaster Loan (EIDL)

What level do Yokais evolve at? - Yo-kai Aradrama Message