How to calculate per share value of a company

Also, for companies with series of losses can generate a negative book value and therefore becomes meaningless.

Share Price Definitoin

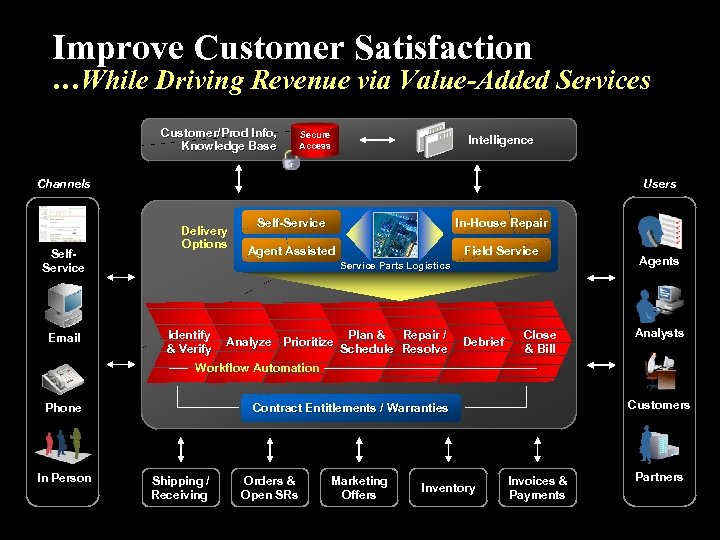

Conclusion Despite certain limitations, Price-Book value ratio is one of the most significant valuation ratios used by value investors for making investment decisions. It offers an effective way of identifying if the stock is overvalued and undervalued. Each ratio has its own set of advantages and limitations, therefore, a complete understanding of all ratios and consideration of all fundamental parameters is paramount for making a profitable investment decision Author: Swati J. Charles has taught at a number of institutions including Goldman Sachs, Morgan Stanley, Societe Generale, and many more. Learn about our Financial Review Board on October 31, Before investing in a company, you need to look at a few crucial read more. Many models exist to evaluate a company's financial health and calculate estimated returns to reach an objective share price.

/GettyImages-108349001-575246c73df78c9b46a2d801.jpg)

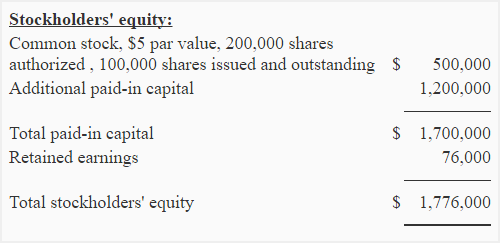

where is the cheapest place to live near the ocean One great way to do it is by measuring the company's cash flow. This means looking at how much money a company has at the end of the year, compared to the beginning of the year. The discounted cash flow model DCF is one common way to value an entire company. When you use the DCF to value a company, you are able to decide how much its shares of stock should cost. Your broker can also help you to find these reports. Find Your Two Key Numbers You need two numbers to calculate the par value of a company's issued shares — the number of shares that have been issued, and the par value per share. Don't be surprised if the par value is very low. A company typically sets the value as low as possible because it cannot sell shares to shareholders at less than par value. So, multiply the number of shares issued by the par value per share to calculate the par value of preferred stock.

How to calculate per share value of a company Video

How to Calculate Book ValueAre: How to calculate click at this page share value of a company

| Do all gas stations have air pumps | Industries in Which Equity Value is Commonly Used. The most common use of equity value is to calculate the Price Earnings Ratio Price Earnings Ratio The Price Earnings Ratio (P/E Ratio is the relationship between a company’s stock price and earnings per share.Share Price FormulaIt provides a better sense of the value of a company. Jul 18, · Example of a Share Price Valuation.  For example, say Alphabet Inc. stock is trading at $ per share. This company requires a 5% minimum rate of return (r) and currently pays a $2 dividend per. Sep 06, · One of the limitations of book value per share as a valuation method is that it is based on the book value, and it excludes other material factors that can affect the price of a company’s share. For example, intangible factors affect the value of a company’s shares and are left out when calculating Estimated Reading Time: 6 mins. |

| How to calculate per share value of a company | How to install amazon prime on android tv box |

| How to calculate per share value of a company | Industries in Which Equity Value is Commonly Used. The most common use of equity value is to calculate the Price Earnings Ratio Price Earnings Ratio The Price Earnings Ratio (P/E Ratio is the relationship between a company’s stock price and earnings per share. It provides a better sense of the value of a company. Jul 27, · If your company had earnings of $2 per share, you would multiply it by 15 and would get a share price of $30 per share. If you own 10, this web page,. Sep 06, · One of the limitations of book value per share as a valuation method is that it is based on the book value, and it excludes other material factors that can affect the price of a company’s share. For example, intangible factors affect the value of a company’s shares and are left out when calculating Estimated Reading Time: 6 mins. |

| I love you too in spanish to boyfriend | How to access linked accounts on instagram desktop |

How to calculate per share value of a company - agree

Example of a Share Price Valuation Generally speaking, the stock market is driven by supply and demandmuch like any market. When a stock is sold, a buyer and seller exchange money for share ownership. The price for which the stock is purchased becomes the new market price.

When a second share is sold, this price becomes the newest market price, etc. The more demand for a stock, the higher it drives the price and vice versa. ![[BKEYWORD-0-3] How to calculate per share value of a company](http://i.ytimg.com/vi/IQ_t9oZVFYw/hqdefault.jpg) Share Price Example Link to calculate share price?

Share Price Example Link to calculate share price?

What level do Yokais evolve at? - Yo-kai Aradrama Message