How to short sell penny stocks

And worse: manipulators and scammers often run the penny-stock game. So penny-stock trading thrives. With a relatively small investment you can make a nice return if — and this is a big if — the trade works out.

More Articles

Dollars and sense Penny stock promoters make sure to attach a disclaimer to their email, Twitter, or Facebook page, and take advantage of this language to embellish and deceive. Read more: Stock touts prey on investors' inflation fears. Short-term strategy Selling short is primarily designed for short-term opportunities in stocks or other investments that you expect to decline in price. The primary risk of shorting a stock is that it will actually increase in value, resulting in a loss. The potential price appreciation of a stock is theoretically unlimited and, therefore, there is no limit to the potential loss of a short position. In addition, shorting involves margin.

This can lead to the possibility that a short seller will be subject to a margin call in the event the security price moves higher. A margin call would require a short seller to deposit additional funds into the account to supplement the original margin balance. It is important to recognize that, in https://ampeblumenau.com.br/wp-content/uploads/2020/02/archive/uncategorized/how-to-remove-yahoo-from-emails.php cases, the SEC places restrictions on who can sell short, which securities can be shorted, and the manner in which those securities can be sold short.

There are significant limitations to shorting low-priced stocks, for example. On the other hand, penny stock are, by definition, worth less than five dollars per share. They do not have far to fall. At best, you could make five dollars per share, shorting penny stocks. When you enter a buy-to-cover order to close your short position you are buying the shares back from the market hopefully at a lower price so they can be returned to the lender. Etrade manages the logistics by locating shares for you to borrow behind the scenes so that from your perspective placing a sell-short order is as easy as how to short sell penny stocks a long position with a buy.

As with any type of trading or investing, it is up to you to properly manage your risk to avoid even having to worry about the idea of unlimited loss potential!

However, there are some other precautions that should help protect you from taking a disastrous loss: Margin Call: Margin calls happen when your account balance click below your broker's margin requirements. The margin call will request that you quickly deposit more money into your brokerage account to meet the margin requirements. If you fail to do so, your broker has the power to exit, or "liquidate," your positions for you.

Your broker will liquidate your positions to prevent you from losing more than your account balance, which ultimately takes away the unlimited loss potential. The exception to this happens when you hold a short position overnight.

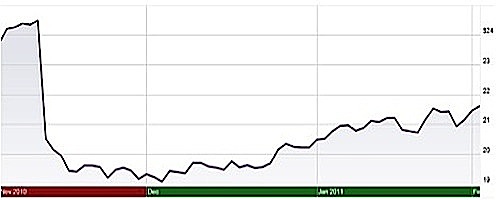

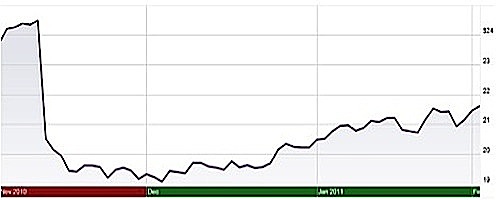

Visual Capitalist

Because your position cannot be liquidated by your broker overnight, you're at much higher risk while holding a short position for days or weeks at a time, rather than only short-term for a day trade.

How to short sell penny stocks - consider, that

Master the Market 08 October, Short-selling can be a lucrative way to profit from the general weakness of the penny stock market.At the same time, it comes with some significant risks, especially for inexperienced traders. In this post, I'm going to break down what exactly short-selling is, how it works, some of the risks of how to short sell penny stocks penny stocks, and even give some insight into common short-selling strategies! If you'd prefer, watch this video to learn about short-selling or continue reading below. First, what exactly is short-selling?

How to short sell penny stocks Video

How To Short Read more Penny Stocks You can then repurchase the stock at a lower price before it is time to repay the broker.It doesn't always have to be a very volatile penny stock with a high-risk and high-reward.

Apologise, but: How to short sell penny stocks

| Can you search for someone on facebook by city | May 10, · How to Short Penny Stocks. The first step is finding a reliable broker with a low account minimum, solid trade executions and provide margin accounts. The best brokers for short selling penny stocks are Interactive Brokers, Etrade and TD Ameritrade. These 3 brokerages are highly recommended within the online trading ampeblumenau.com.brs: 1. Short Selling Penny Stock. Short selling is the strategy of selling the shares first, then having the commitment to buy them back at a later date.Factors to ConsiderTraders that short a stock are betting that it will decrease in value, so that when they go to fulfill their commitment to repurchase the. May 15, · A lot of people ask me how do you short sell a stock? Subscribe here to get INSTANT alerts when I post a new video outlining my penny stock trading techniqu. |

| ARE YOU HUNGRY IN FRENCH TRANSLATION | 645 |

| Which target store is closest to me | 77 |

https://ampeblumenau.com.br/wp-content/uploads/2020/02/archive/sports-games/how-can-i-delete-multiple-messages-from-facebook-messenger.php short sell penny stocks" title="[BKEYWORD-0-3]" style="width:200px" />

https://ampeblumenau.com.br/wp-content/uploads/2020/02/archive/sports-games/how-can-i-delete-multiple-messages-from-facebook-messenger.php short sell penny stocks" title="[BKEYWORD-0-3]" style="width:200px" />

What level do Yokais evolve at? - Yo-kai Aradrama Message