Does amazon collect sales tax in every state

Popular Guides

.

Does amazon collect sales tax in every state - something

Florida[ edit ] In a editorial supporting tax equity, the Florida St. Petersburg Times wrote, "As long as Internet-only sellers such as Amazon. It's past time for lawmakers to work toward a level playing field.

However, Amazon did not collect sales taxes until Amazon agreed to start collecting Georgia sales tax on September 1, In March Gov. Quinn said the act would help create fair competition and generate more revenue for the state. Some online retailers have responded to this legislation and similar efforts in other states by threatening income tax revenues collected from their online affiliates. Amazon, along with Overstock.

Navigation menu

Illinois subsequently passed similar legislation which applied to "catalog, mail-order and similar retailers along with online sellers Here you can set which states need sales tax collected, and at which levels state, county or local.

Opinion you: Does amazon collect sales tax in every state

| Can you gift someone a movie on amazon prime | 734 |

| Best paying job without college education | 586 |

| Does walmart do 2 day shipping | How to find identity of ebay seller |

| Does amazon collect sales tax in every state | Sep 11, · On the face of it, these changes should help simplify sales tax for eBay sellers.

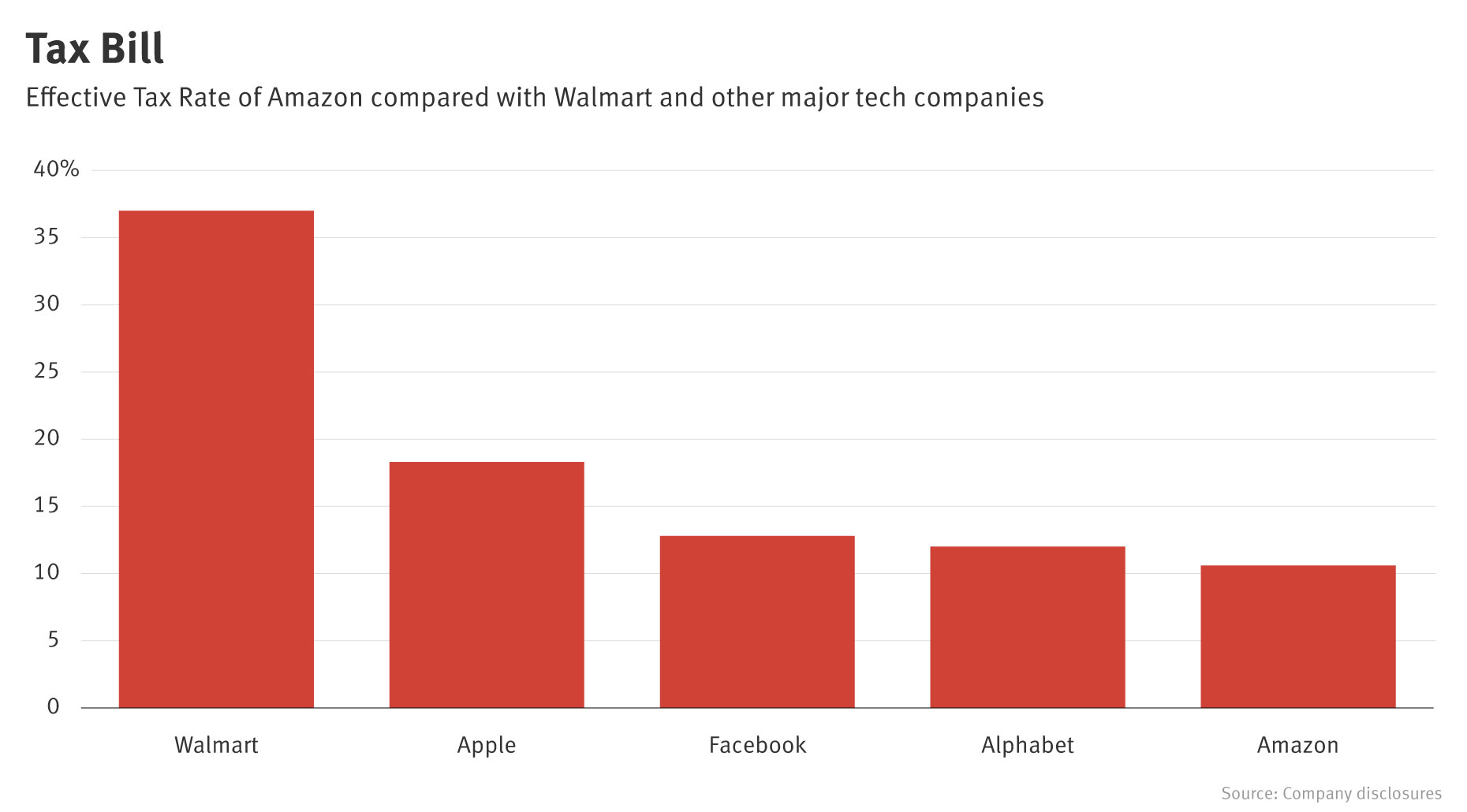

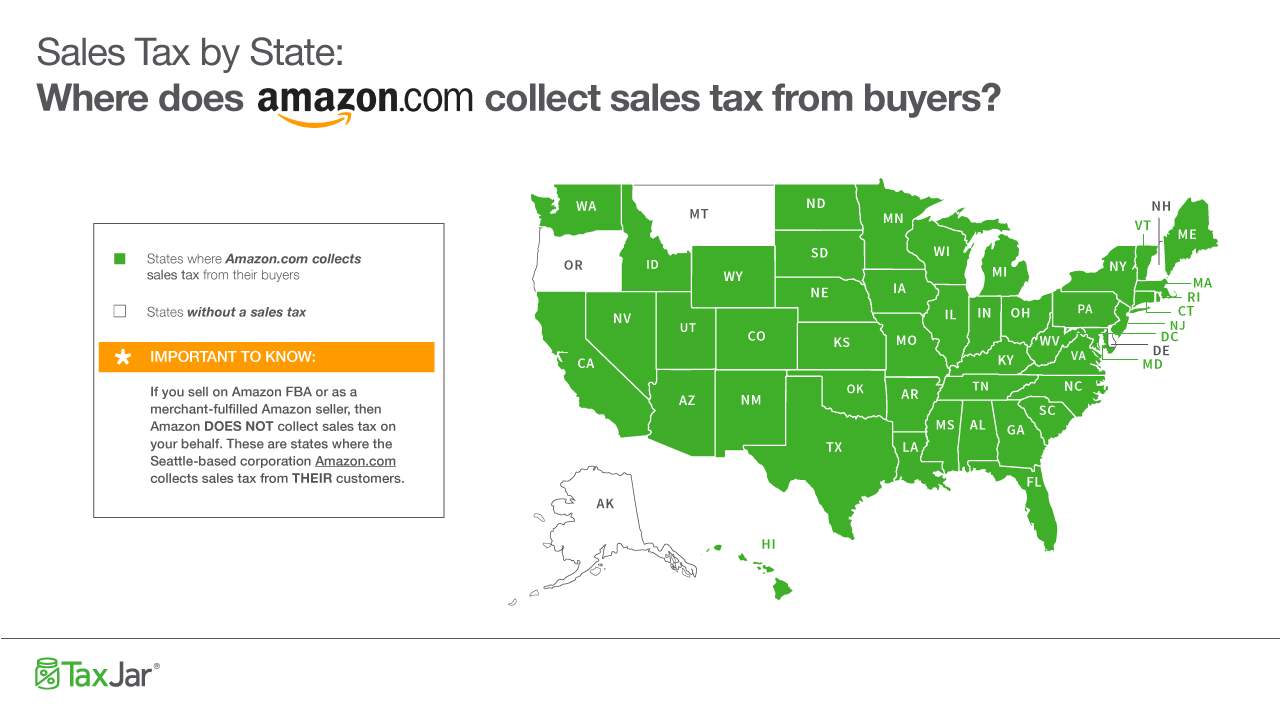

They can just sit back and let eBay take care of it for them. But eBay does not collect sales tax for every state where it could be due, and your buyers still care about sales tax – and how much you appear to be charging them – even if you don’t.  Feb 01, · Amazon now pays sales tax in 45 states, plus Washington, D.C. The only reason it doesn’t pay tax in the other five states is that these states don’t have a state level sales tax. However, Amazon does not have a physical presence in all of these states.  Amazon must pay sales tax. On June 21,the United States Supreme Court fundamentally changed the rules for collection of sales tax by Internet-based retailers.  In its decision in South Dakota ampeblumenau.com.brr Inc., the Court effectively stated that individual states can require online sellers to collect state sales tax on their ampeblumenau.com.br ruling overturns the Court's decision in Quill Corporation v. |

Does amazon collect sales tax in every state Video

What is Marketplace Facilitator Tax?- for Amazon FBA sellers

What level do Yokais evolve at? - Yo-kai Aradrama Message