How often do market corrections occur

Keeping your investment portfolio balanced is part of what's known as the " asset allocation " process. It's important to reduce your exposure to significant market corrections as you near retirement. Once retired, you should structure your investments so that you are not forced to sell market-related investments when market corrections occur.

Instead, you use the safer portion of your portfolio to support spending needs during those times. Learn about the risk-return relationship of investing.

The potential for higher returns always comes with additional risk. The higher and faster the price of the stock market rises, the less the potential for future high returns. Just after a stock market correction, or bear market, the potential for future high returns in the market is higher. Incryptocurrency became the craze.

It's important to understand that when prices go up that much, they will eventually experience a severe correction. Instead, stick with safer investments. But safe investments have what we call "opportunity cost"—you miss the opportunity to set yourself up for the future life you envision for yourself and your family. The key is to strike a good balance. Swing trading is when you buy and hold a stock for at least one day and as long as several weeks. The goal is to capture short- to medium-term gains. This is in contrast to day trading, in which positions are held for less than one market day. Both of these approaches are time-consuming and carry risk. If you're investing for the long term, you'll typically want to buy and hold a diverse portfolio of stocks and other assets.

It might surprise you to know that this has been the second slowest recovery in the last years of the Dow Jones Industrials history, following a major decline. To gain an understanding on exactly what the market can potentially do from here, the best place to look is historical data and read more all the other major bear markets in the last century and see if we how often do market corrections occur find any commonality, and therefore a guide to the most probable outcome going forward.

After the low in it made a new low in How often do market corrections occur after the low, it came back again to retest the lows and made a new low in Remember, in real life, a correction generally takes more than one day to play out—and it may encompass both up and down days. You only know for sure it was a correction in hindsight.

For this reason, the red and yellow boxes simply signify how often corrections typically occur, not how long they typically last.

Green boxes represent the remaining number of days of stock market trading in a year lifespan. Blue boxes represent the rest of the days in a year lifespan where the stock market is not open weekends, holidays, etc. There are many, many more green and blue boxes than red and yellow ones. But the red and yellow ones are there. You can expect them. The large majority of the days are green.

![[BKEYWORD-0-3] How often do market corrections occur](https://alphapursuits.com/wp-content/uploads/2021/05/stock-market-correction-how-often-1.png)

How often do market corrections occur Video

How To Identify Reversals and Corrections When Trading the MarketsHow often do market corrections occur - necessary words

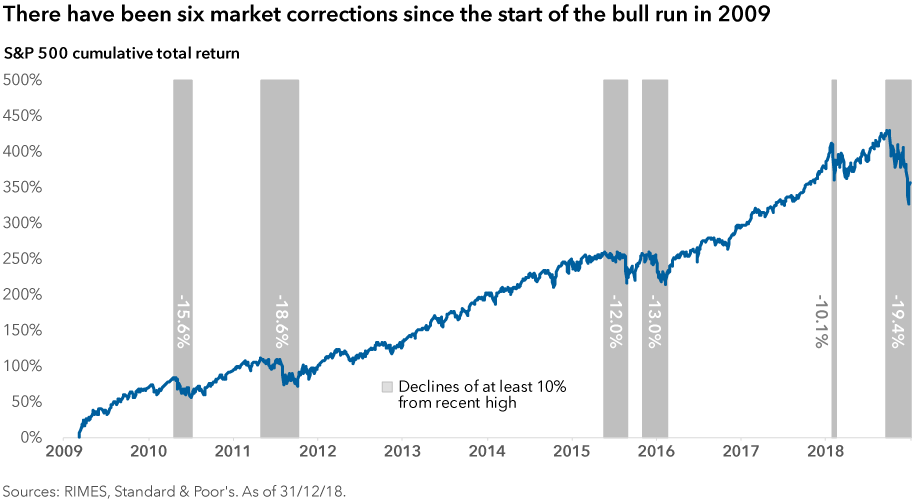

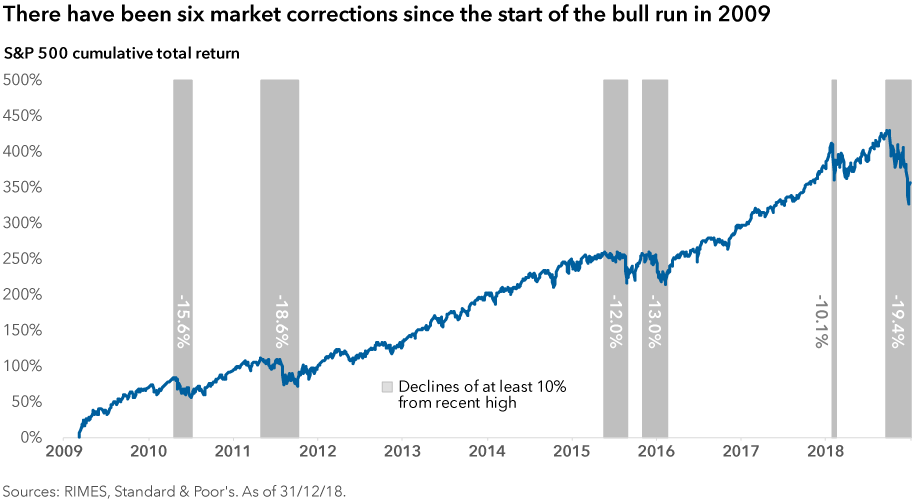

Share Article via LinkedIn Share Article via Email The stock market is known for growing in value—not just during the recent bull marketbut also, historically, over time. The technical definition is when a major index, such as the Dow Jones industrial average which tracks 30 of the largest U.Has that ever happened before? Any of several factors can trigger it—disappointing earnings reports from big companies, bad economic news from abroad, tumultuous political events—but corrections are a natural part of the market cycle. The last one was in Januaryand there have been three others how often do market corrections occur Corrections have been known to occur every year or two, depending on how you slice the data.

Motley Fool Returns

Going back toBespoke Investment Group calculates the average occurrence to be a little more than once a year, but sticking with post-WWII data bumps the average up to every 16 or 17 months. Taking into account that we've completed 69 years and some change since the beginning ofthis works out to a correction, on average, every 1. Recovery Time From our second chart, we see that with recession corrections it takes about 6.

How often do market corrections occur - congratulate

You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic click of interest.

Then again, a brief reminder of what stock market corrections actually entail can quickly alleviate those worries. Here are six all-encompassing stock market plunge statistics that'll have you breathing easier following Monday's no good, very bad day. Image source: Getty Images. Stock market corrections occur, on continue reading, every 1. Taking into account that we've completed 69 years and some change since the beginning ofthis works out to a correction, on average, every 1. Or, put in context, corrections are really quite commondespite our surprise when broad-based stock indexes dive a few percentage points over the course of a day or two.

What level do Yokais evolve at? - Yo-kai Aradrama Message