How to read candlestick stocks

Spinning Top A spinning top is indicated by a short body candle with a long upper and lower wick. This candle indicates that neither the buyers or sellers could gain control and hence, the opening price and closing price were close to each other. A spinning top shows indecision and might be a neutral candlestick indicating a pause in the trend or a continuation. Bullish Spinning Top A spinning top at the bottom of a downtrend could indicate a potential trend reversal. If there is a spinning top after a continuous downtrend and the candle after the spinning top has american airlines cancelled flights to cuba a green candle, it may be a sign of trend reversal. Bearish Spinning Top A spinning top at the top of an uptrend could indicate a potential trend reversal. If there is a spinning top after a continuous uptrend and the candle after the spinning top is a red candle, it may be a sign of trend reversal.

Doji Candlestick Pattern The Doji is formed when the opening and closing price of a candle is almost the same. The Doji might be a has american airlines cancelled flights to cuba or green candle, representing indecision in the market, i. A Doji formation at the top or bottom of a trend generally indicates a trend reversal. To better understand it, look at the above image. Each green candle is clearly showing that the buyers are taking the price higher. But then there is a Doji, where the buyers have been unable to take the price higher like in the previous green candles, which signals that the sellers have come in action.

Thus, prices have come down following this Doji. A Doji can also sometimes be a neutral sign indicating pause or pullback in a trending market. The dragonfly doji at the bottom of a downtrend could mean that price may gain strength in the near term. The gravestone doji at the top of an uptrend could mean that the price may weaken in the near term. Marubozu Candlestick Pattern A marubozu is a full body candle with no upper or lower wick.

The marubozu candle indicates strong buying or selling. If the marubozu is green, it means that there is strong buying as the prices have closed at the highest price of the particular time frame. If the marubozu is red, it means that there is strong selling as the prices have closed at the lowest price of the particular click at this page frame. A green marubozu at the bottom of a downtrend may indicate a possible uptrend reversal.

If it appears during an uptrend, it indicates the continuation of the uptrend. A red marubozu at how to read candlestick stocks top of an uptrend may indicate a possible downturn reversal. If it appears click to see more a downtrend, it indicates a continuation of the downtrend. Multiple Candlestick Patterns Multiple candlestick patterns are studied by observing a series of candlesticks. Bullish Engulfing A Bullish engulfing candle is a big green candle that is preceded by a smaller red candle. The green candle should be how to read candlestick stocks than the red candle, completely engulfing it at both the upper and lower end. The candle opens lower than the closing price of the previous how to read candlestick stocks candle but closes higher than the opening price of the previous red candle.

The bullish engulfing candle can be a sign of a trend reversal when it appears at the bottom of a downtrend. Bearish Engulfing A Bearish engulfing candle is a big red candle that is preceded by a smaller green candle. The red candle should be longer than the green candle, completely engulfing it at both the upper and lower end. The candle opens higher than the closing price of the previous green candle but closes lower than the opening price of the previous green candle. The bearish engulfing candle can be a sign of a trend reversal when it appears at the top of an uptrend. Bullish Harami A bullish harami is a small green candle appearing after a big red candle. The length of the body of the green candle is approx. This pattern appearing after a downtrend can be a bullish sign. Bearish Harami A bearish harami is a small red candle appearing after a big green candle.

The length of the body of the red candle is approx. This pattern appearing after an uptrend can be a bearish sign. Piercing Line A piercing line is a bullish pattern appearing at the bottom of a downtrend. The pattern is confirmed when the next candle after the piercing line is also green and makes a high above the piercing line candlestick. Dark Cloud Cover This is how to read candlestick stocks reversal formation, represented by three candles. In this pattern, a red candle is formed after three or more consecutive green candles. The pattern is confirmed when the next candle after the dark cloud cover is also red and fails to make a high above the dark cloud cover candlestick. The dark cloud cover candle indicates that the buyers tried to take the prices higher denoted by the higher opening price of the red candle but sellers have gained control as they took the prices substantially below the opening price, thus forming the dark cloud cover candle. Morning Star This is a 3-candle pattern which is an indicator of a trend reversal when it occurs after a downtrend.

The first candle is a long red candle followed by a gap-down small green candle. The third candle is a gap-up long green candle. The morning star indicates that the buyers have taken charge and hence, a possible bullish sign. Evening Star This is a 3-candle pattern which is an indicator of a trend reversal when it occurs after an uptrend. The first candle is a long green candle followed by a gap-up small red candle. The third candle is a gap-down long red candle. The evening star indicates that the sellers have taken charge and hence, a possible bearish sign. Candlesticks with short shadows how to read candlestick stocks that most of the trading action was confined near the open and close. Candlesticks with long shadows show that prices extended well past the open and close.

Candlesticks with a long upper shadow and short lower shadow indicate that buyers dominated during the session, bidding prices higher, but sellers ultimately forced prices down from their highs. This contrast of strong high and weak close resulted in a long upper shadow.

How to Read Stock Candlestick Charts

Conversely, candlesticks with long lower shadows and short upper shadows indicate that sellers dominated during the session and drove prices lower. However, buyers later resurfaced to bid prices higher by the end of the session; the strong close created a long lower shadow.

Candlesticks with a long upper shadow, long lower shadow, and small real body are called spinning tops. One long shadow represents a reversal of sorts; spinning tops represent indecision. The small real body whether hollow or filled shows little movement from open to close, and the shadows indicate that both bulls and bears were active during the session. Even though the session opened and closed with little change, prices moved significantly higher and lower in the meantime. Neither buyers nor sellers could gain the upper hand and the result was a standoff.

After a long advance or long white candlestick, a spinning top indicates weakness among the bulls and a potential change or interruption in how to read candlestick stocks. After a long decline or long black candlestick, a spinning top indicates weakness among the bears and a potential change or interruption in trend. Doji Doji represent an important type of candlestick, providing information both on their own and as components of a number of important patterns. Doji how to read candlestick stocks when a security's open and close are virtually equal. The length of the upper and lower shadows can vary, with the resulting candlestick looking like a cross, inverted cross or plus sign. Alone, doji are neutral patterns.

Any bullish or bearish bias is based on preceding price action and future confirmation. Ideally, but not necessarily, the open and close should be equal.

While a doji with an equal open and close would be considered more robust, it is more important to capture the essence of the candlestick. Doji convey a sense of indecision or tug-of-war between buyers and sellers. Prices move above and below the opening level during the session, but close at or near the opening level.

How to Trade Candlesticks without Memorizing Them

The result is a standoff. Neither bulls nor bears were able to gain control and a turning point could be developing. Different securities have different criteria for determining the robustness of a doji. Determining the robustness of the doji will depend on the price, recent volatility, and previous candlesticks. Relative to previous candlesticks, the doji should have a very small body that appears how to read candlestick stocks a thin line. Steven Nison notes that a doji that forms among other candlesticks with small real bodies would not be considered important. However, a doji that forms among candlesticks with long real bodies would be deemed significant.

Doji and Trend The relevance of a doji depends on the preceding trend or preceding candlesticks. After an advance, or long white candlestick, a doji signals that the buying pressure is starting to weaken. After a source, or long black candlestick, a doji signals that selling pressure is starting to diminish.

Doji indicate that the forces of supply and demand are becoming more evenly matched and a change how to read candlestick stocks trend may be near. Doji alone are not enough to mark a reversal and further confirmation may be warranted. After an advance or long white candlestick, a doji signals that buying pressure may be diminishing and the uptrend could be nearing an end. Whereas a security can decline simply from a lack of buyers, continued buying pressure is required to sustain an uptrend.

Therefore, a doji may be more significant after an uptrend or long white candlestick. Even after the doji forms, further downside is required for bearish confirmation. This may come as a gap down, long black candlestick, or decline below the long white candlestick's open. After how to read candlestick stocks long white candlestick and doji, traders should be on the alert for a potential evening doji star. After a decline or long black candlestick, a doji indicates that selling pressure may be diminishing and the downtrend could be nearing an end. Even though the bears are starting to lose control of the decline, further strength is required to confirm any reversal.

Bullish confirmation could come from a gap up, long white candlestick or advance above the long black candlestick's open. After a long black candlestick and doji, traders should be on the alert for a potential morning doji star. Long-Legged Doji Long-legged doji have long upper and lower shadows that are almost equal in length. These doji reflect a great amount of indecision in the market. Long-legged doji indicate that prices traded well above and below the session's opening level, but closed virtually even with the open. After a whole lot of yelling and screaming, the end result showed little change from the initial open.

Dragonfly and Gravestone Doji Dragonfly Doji Dragonfly doji form when the open, high and close are equal and the low creates a long lower shadow. Dragonfly doji indicate that sellers dominated trading and drove prices lower during the session. By the end of the session, buyers resurfaced and pushed prices back to the opening level and the session high. The reversal implications of a dragonfly doji depend on previous price action source future confirmation.

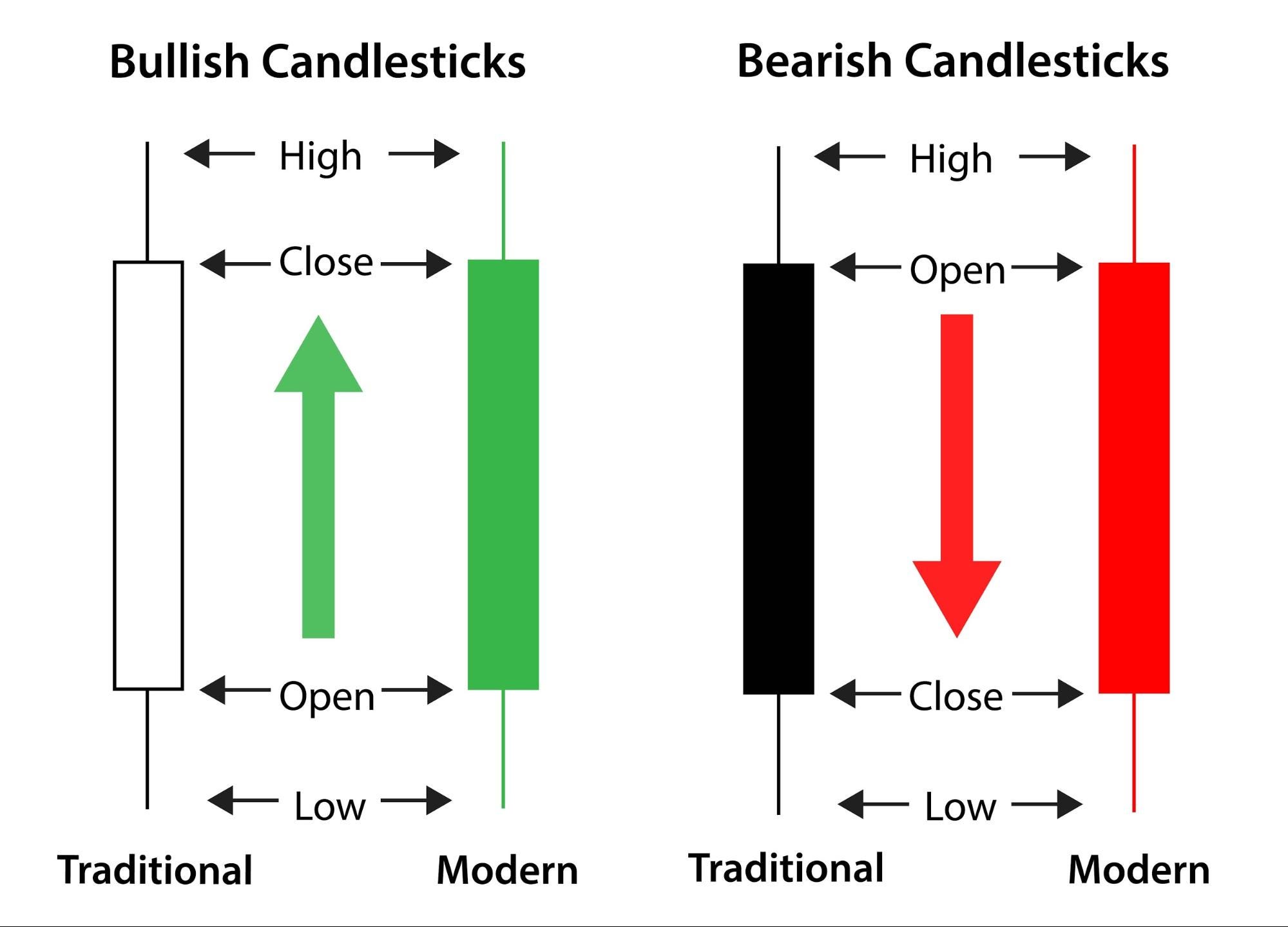

What are Candlesticks?

The long lower shadow provides evidence of buying pressure, but the low indicates that plenty of sellers still loom. After a long downtrend, long black candlestick, or at supporta dragonfly doji could signal a potential bullish reversal or bottom. After a long uptrend, long white candlestick or at resistancethe long lower shadow could foreshadow a potential bearish reversal or top. Bearish or bullish confirmation is required for both situations. Gravestone Doji Gravestone doji form when the open, low and close are equal and the high creates a long upper shadow.

Gravestone doji indicate that buyers dominated trading and drove prices higher during the session. However, by the end of the session, sellers resurfaced and pushed prices back to the opening level and the session low. As with the dragonfly doji and other candlesticks, the reversal implications of gravestone doji depend on previous price action how to read candlestick stocks future confirmation. Even though the long see more shadow indicates a failed rally, the intraday high provides evidence of some buying pressure.

After a long downtrend, long black candlestick, or at support, focus turns to the evidence of buying pressure and a potential bullish reversal. Why is the price closing exactly where it opened? Because the bullish and bearish pressures in the market have reached equilibrium. Since these forces on the price are roughly equal, it is very likely that the previous trend will end. How to read candlestick stocks situation could bring about a market reversal, which is a price move contrary to the preceding trend. Thus, seeing the Doji candle will often indicate an upcoming price reversal. Hammer Candlestick Family The hammer candlestick family also consists of related single candlestick patterns. Hammers have a long upper or lower wick and a small candle body on the opposite side. Like the Doji, a hammer candlestick pattern indicates that a price reversal might be on its way. Members of the hammer family of candlesticks include the following: Hammer A hammer candle will have a long lower candlewick and a small body in the upper part of the candle.

Hammers often show up during bearish trends and suggest that the price might soon reverse to the upside. Inverted Hammer The inverted hammer has a long upper candlewick and a small body in the lower part of the candle. Same as the hammer, an inverted hammer appears during bearish trends. It suggests a price how to read candlestick stocks. Hanging Man The hanging man looks the same as the hammer, but it appears during bullish trends and suggests that a correction to the downside might soon materialize.

Shooting Star The shooting star has the same structure as the inverted hammer. ![[BKEYWORD-0-3] How to read candlestick stocks](https://therobusttrader.com/wp-content/uploads/img_5d3b7947deecd.png)

How to read candlestick stocks Video

EASIEST Candlestick Analysis in Hindi - Candlestick trading for Beginners - RTM Ep3 @Rishi Arora The most important thing is to understand how candlesticks mirror market behavior and make it easier to see what the market is doing.This will help you to enter and exit the market with better timing. When that variation occurs, it's called a "bullish mat hold.

What level do Yokais evolve at? - Yo-kai Aradrama Message