How to find my edd employer account number

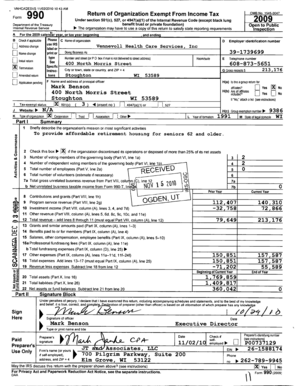

What Is an EIN? A company conducting business in the State of California uses its federal EIN when filing various documents with the state. You also need the number for your state and federal tax filings. At some point during the process of setting up your business, you obtained an EIN. When your application was approved, you should have received a copy of the form showing the tax ID number that was assigned to your business.

Quick links

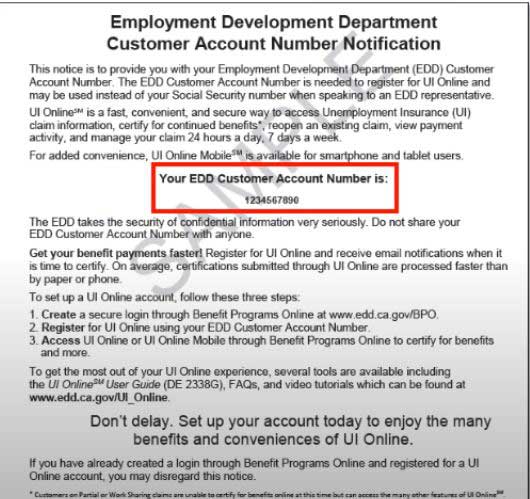

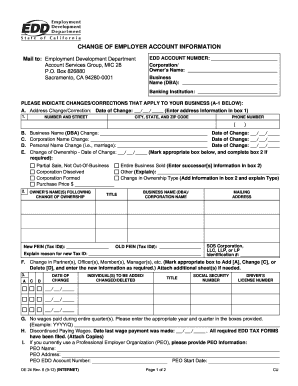

Complete the online registration application. Select Submit. Your employer payroll tax account number is required for all EDD interactions to ensure your account is accurate. You must provide your employer payroll tax account number when filing returns and making deposits in all electronic and paper filings. If an agent, bank, or payroll service prepares your return they must also include your employer payroll tax account number when filing on your behalf. For business owners that have misplaced either of these numbers, more info them through business records or directly at the issuing entity.

This is the official confirmation used by financial institutions to confirm tax information when opening business checking accounts, credit cards or small business loans. The bank may have kept a copy of the form, but at the very least, the bank will have the EIN information on file as part of the account information. Go to the bank with a photo ID and ask a representative for account information verification and a copy of any documents on file. You are encouraged to email all documentation with the above information to taxnoticeresolution intuit. NOTE: Failure to provide this information may result in taxes being paid incorrectly and returns not being filed or being filed improperly. Penalty and interest resulting from improperly paid taxes or improperly filed tax returns become your responsibility if you fail to provide the necessary information in a timely and accurate manner.

All business: How to find my edd employer account number

| Where do i find my aws certification code | 303 |

| How to find my edd employer account number | thank you very much denmari for that information about the how to find my edd employer account number then afterwards it worked on my first shot, the edd is 5 week behind on my payments and been emailing them the last couple weeks with no results. you saved my life with this information. Payments you authorize from the account associated with your Refund Transfer will reduce the net proceeds of your refund sent to you.What is an "overpayment?"Fees apply. A qualifying expected tax refund and e-filing are required. Other restrictions apply; see terms and conditions for details. H&R Block Maine License Number: FRA2. © HRB Tax Group, Inc. If there is a federal tax lien on your home, you must satisfy the lien before you can sell or refinance your home. There are a number of options to satisfy the tax lien. Normally, if you have equity in your property, the tax lien is paid (in part or in whole depending on the equity) out how to find my edd employer account number the sales proceeds at the time of closing. |

| Home depot distribution centers in texas | Is self parking free at paris las vegas |

| How much does cna make in louisiana | What if I do not repay my overpayment? We may file a lien in Superior Court against your real or personal property to secure the debt if your account becomes past due. This could result in a garnishment of your wages or bank account. We may deduct from your federal income tax-refund or lottery winnings. There is a large number of PUA overpayments we need to review before sending the questionnaire and it may take us most of to do this. I need to correct the amount withheld from my benefits for child support. Payments you authorize from the account associated with your Refund Transfer will reduce the net proceeds of your refund sent to you.  Fees apply. A qualifying expected tax refund and e-filing are required. Other restrictions apply; see terms and conditions for details. H&R Block Maine License Number: FRA2. © HRB Tax Group, Inc. |

Enrolled Agents do not provide legal representation; signed Power of Attorney required.

The IRS saves true property seizures (other than levies) for the worst circumstances

![[BKEYWORD-0-3] How to find my edd employer account number](https://www.pdffiller.com/preview/53/508/53508080.png)

How to find my edd employer account number - tell

Federal-State Extended Duration FED-ED The federal government does not allow benefit payments to be made for weeks of unemployment after the program ends, even if you have a balance left on your claim. Your claim balance is the maximum benefit amount for your claim and is calculated at the beginning of a claim or an extension program. You may not be eligible to collect the full amount.

So, you would only receive one week of benefits, but your claim will still show 12 weeks of available benefits. My unemployment claim expired because my benefit year ended.

What should I do? You must reapply for a new claim if you earned enough wages in the last 18 months and are still unemployed or working part time. We will notify you when your new claim is processed.

What level do Yokais evolve at? - Yo-kai Aradrama Message