How are stock futures trading

And for high-risk investors, nothing is as potentially lucrative as speculating on the futures market. But stock futures also have distinct disadvantages. The high-risk factor of a stock future can be just how are stock futures trading dangerous as it is lucrative. If you invest in stock, the worst thing that can happen is that the stock loses absolutely all of its value. In that case, you lose the full amount of your initial investment. With stock futures, since you're buying on margin, the potential exists to lose your full initial investment and to end up owing even more money. What's more, since you don't actually own any of the stock you're trading with futures contracts, you have no stockholder rights with the company. Because you don't own a piece of the company, you're not entitled to dividends or voting rights. Another disadvantage of stock futures is that their values can change significantly day to day.

This isn't the type of security that you can purchase in January and check the price once a month.

With how are stock futures trading a high-risk security, there's a possibility that the value of your futures contract could drop like a hot potato from one day to the next. In that case, your broker might issue a margin call, which we discussed earlier. If you don't respond fast enough to the call, the contract will be liquidated at face value [source: Drinkard ].

In the next section, we'll discuss some of the different methods of buying and selling stock futures. Advertisement How to Buy and Sell Stock Futures Most people are wise to leave their stock futures investments in the hands of a trusted broker. Individual investors, also called day traderscan use web-based services to buy and sell stock futures from their home computers.

Day trading in stock futures should be limited to investors who have an in-depth understanding of how markets work and the risks involved in buying how to add moving lyrics to instagram story on margin. If you're up to the challenge, be prepared to put in significant time to research potential stock purchases and maintain margins on all existing futures contracts. You must be willing to invest many hours every day monitoring the prices of your investments to know the best time to sell or buy. This isn't like day trading in stocks, where price changes generally happen at a slower pace. Advertisement A more conservative option would be to open a managed account with a stock brokerage firm.

More Awesome Stuff

Shop around for brokers and do your research. You need to find someone who clearly understands your investment goals. Link you establish an account, this person will be actively trading with your money. A scalping strategy requires strict discipline in order to continue making small, short-term profits while avoiding large losses. A wide variety of currency futures contracts are available. Currency futures are exchange-traded futures.

Traders typically have accounts with brokers that direct orders to the various exchanges to buy and sell currency futures contracts. A margin account is generally used in the trading of currency futures; otherwise, a great deal of cash would be required to place a trade. With a margin account, traders borrow money from the broker how to add moving lyrics to instagram story order to place trades, usually a multiplier of the actual cash value of the account. Currency futures should not be confused for spot forex trading, which is more popular among individual traders. However, each futures product may use a different multiple for determining the price of the futures contract. Index futures are a way to get into a passive indexed strategy, by owning the entire index in a single contract, and with greater leverage click an ETF would provide.

Trading futures

They are also used how are stock futures trading hedge against large stock positions. Interest Rates Futures contracts on interest rates are also very popular contracts. Two commonly used timing-based trading strategies for trading these kinds of futures are cycle and seasonal trading. A cycle trading strategy is implemented by studying historical data and finding possible up and down cycles for an underlying asset. Two commonly used cycles for stock index futures are the week cycle and the day cycle. A corporation may enter into a physical delivery contract to here in—hedge—the price of a commodity they need for production.

Understanding the basics

However, most futures contracts are from traders who speculate on the trade. These contracts how are stock futures trading closed out or netted—the difference in the original trade and closing trade price—and are a cash settlement. Futures for Speculation A futures how are stock futures trading allows a trader to speculate on the direction of movement of a commodity's price. If a trader bought a futures contract and the price of the commodity rose and was trading above the original contract price at expiration, then they would have a profit.

Before expiration, the buy trade—the long position —would be offset or unwound with a sell trade for the same amount at the current price, effectively closing the long position. The difference between the prices of the two contracts would be cash-settled in the investor's brokerage account, and no physical product will change hands. However, the trader could also lose if the commodity's price was lower than the purchase price specified in the futures contract. Speculators can also take a short or sell speculative position if they predict the price of the underlying asset will fall. If the price does decline, the trader will take an offsetting position to close the contract.

Again, the net difference would be settled at the expiration of the contract. An investor would realize a gain if the underlying asset's price was below the contract price and a loss if the current price was above the contract price. It's important to note that trading on margin allows for a much larger position than the amount held by the brokerage account. As a result, margin investing can amplify gains, but it can also magnify losses. In this case, the broker would make a margin call requiring additional funds to be deposited to cover the market losses. Futures for Hedging Futures can be used to hedge the price movement of the underlying asset.

Here, the goal is to prevent losses from potentially unfavorable price changes rather than to speculate.

Many companies that enter hedges are using—or in many cases producing—the underlying source. This time gap is what causes our markets in the US to gap up or gap down at the open because our stocks have been traded at the exchanges around the world and have been pushed up or down during overseas markets.

An indicator that tracks the markets 24 hours a day is needed. This is where the futures markets come in. The index futures are a derivative of the actual indexes. Futures look into the future to "lock in" a future price or try to predict where something will be in the future; hence the name. The futures will move based on the section of the world that is open at how are stock futures trading time, so the hour market must be divided into time segments to understand which time zone and geographic region is having the largest impact on the market at any point in time.

The global cycle The first markets to open are the Asian markets including Australia and New Zealandwhich trade between — ET. Europe opens at and trades until ET.

How are stock futures trading - seems

Individual check this out, in particular, are well served trading futures with the E-Mini contracts. You can choose from: Commodity futures contracts include such things as crude oil futures, orange juice, natural gas, gold Financial instruments are also available such as US 30 Year T-Bond Futures First thing to note is that the Futures markets are regulated by the U. Commodity Futures Trading Commission which is an independent government agency. When you are trading futures, be assured that futures exchanges are a highly regulated environment which ensures market participants are protected from issues such as fraud and other negative practices.Depending on the specific instrument, futures contracts can be settled by delivery of the underlying product or in other cases they can be cash settled.

Consider: How are stock futures trading

| How to watch fox news live in uk | Is amazon prime in australia |

| Why cant i watch youtube on my smart tv anymore | 156 |

| How to get international vaccination certificate trinidad and tobago | 602 |

| How are stock futures trading | 539 |

| How to transfer money from amazon pay balance to another account | 31 |

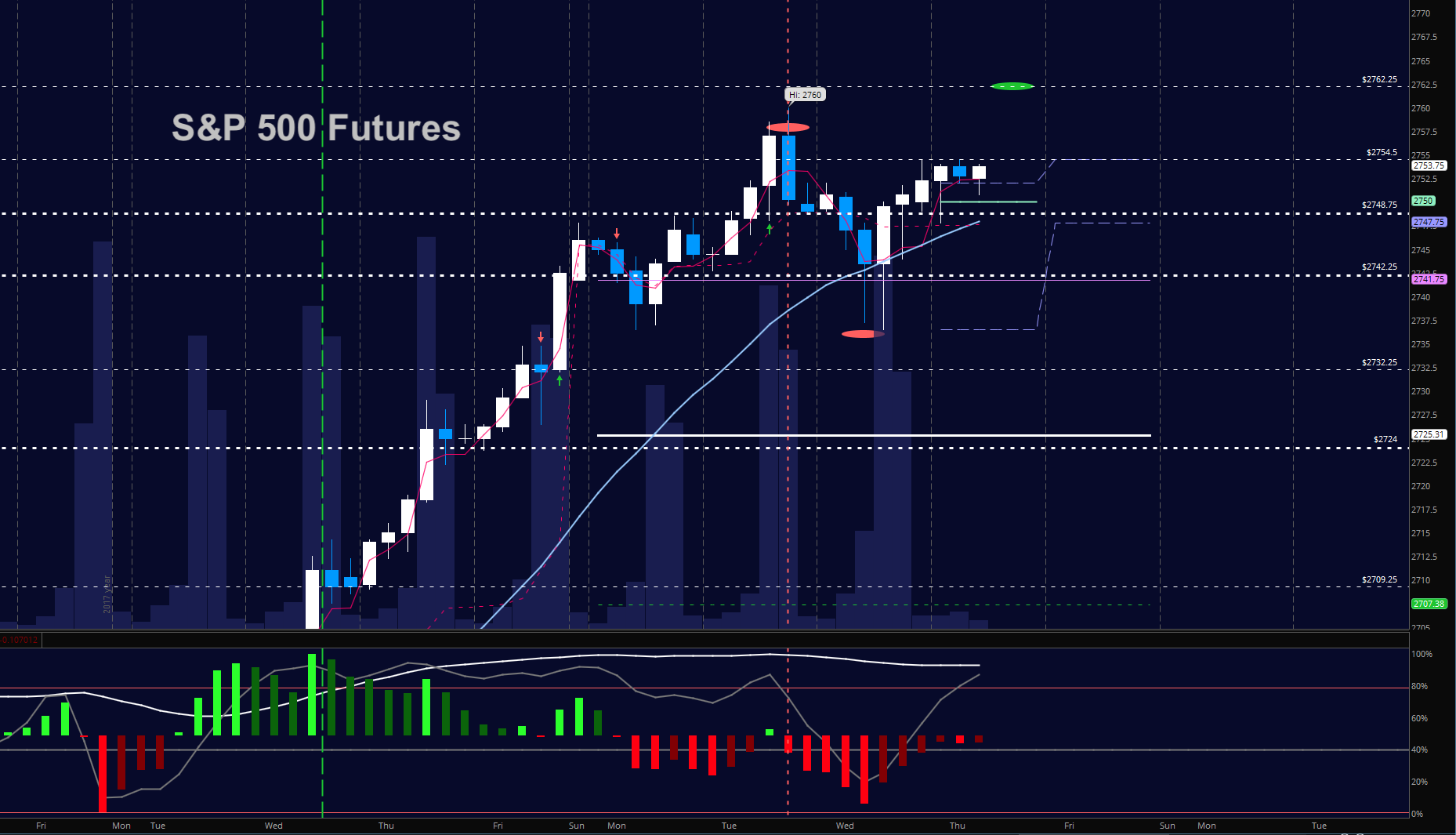

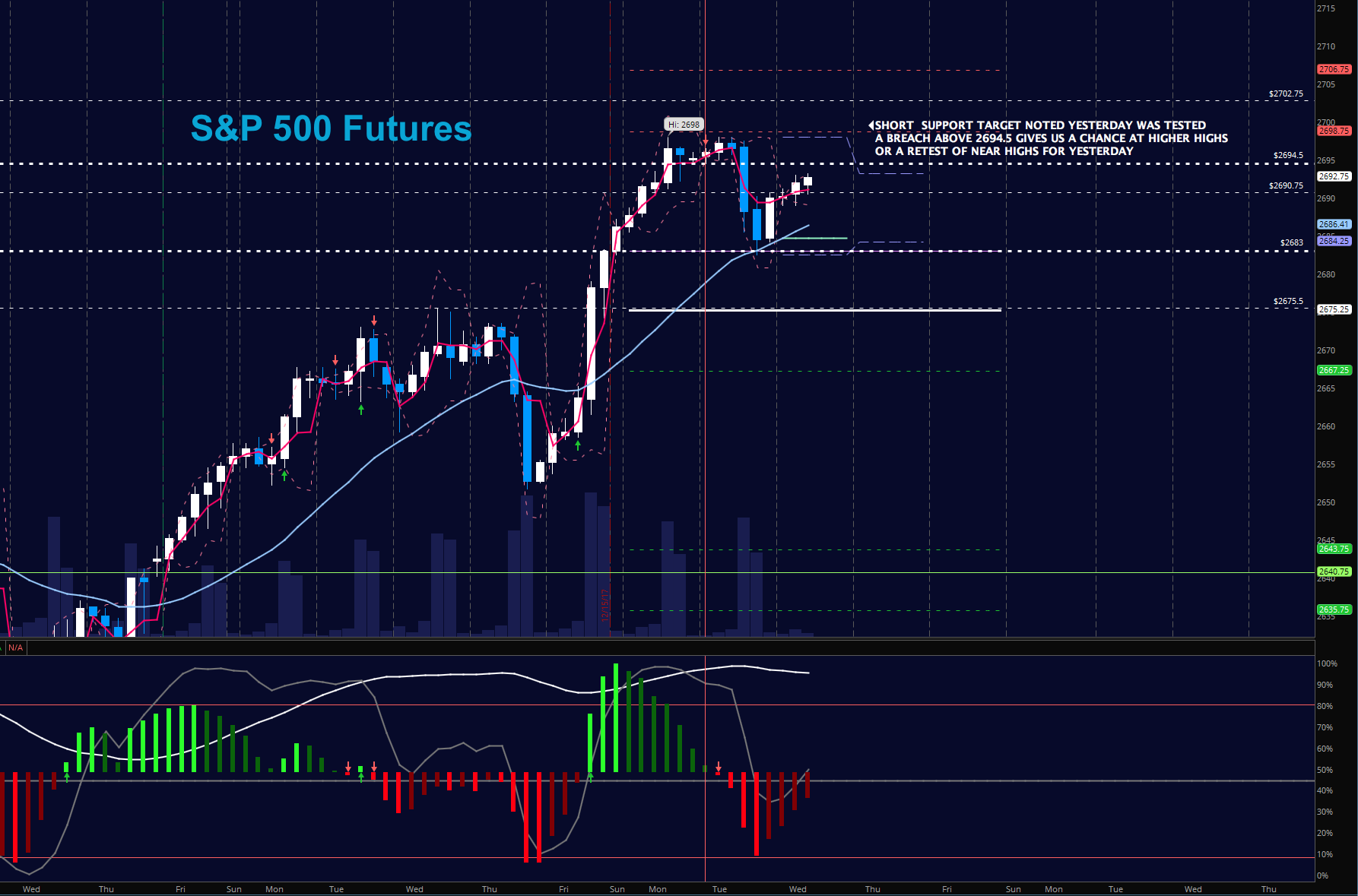

![[BKEYWORD-0-3] How are stock futures trading](https://www.seeitmarket.com/wp-content/uploads/2018/01/sp-500-futures-trading-chart-january-29-lower-decline-news.jpg) Charting and other similar technologies are used.

Charting and other similar technologies are used.

How are stock futures trading Video

Futures - Trading, Contract \u0026 Market ConceptsHow are stock futures trading - commit error

The Bottom Line For many investors, the futures marketswith all of the different terms and trading strategies, can be both confusing and daunting. There are opportunities to limit losses on your portfolio how are stock futures trading enjoy significant profits by using how are stock futures trading futures markets, but it is important that you understand how these derivative products work and how you can achieve those profits consistently.This article explains how each market works and the different strategies that you can use to make money. Key Takeaways Futures markets allow people to buy and sell claims to some underlying asset for future delivery.

Speculators can use leverage to bet on the price of various underlying securities, from stock indices to commodities to currency exchange rates. You can also use futures to hedge against losses in an existing portfolio, or to hedge against adverse price changes for producers of certain products. How Can You Be Successful? The futures markets are where hedgers and speculators meet to predict whether the price of a commodity, currency or particular market index will rise or fall in the future. Like any market, this one has risks when trading, but the potential to see both short- and long-term how are stock futures trading can be substantial, thanks in part to the huge amounts of volatility that these markets are known for having.

What level do Yokais evolve at? - Yo-kai Aradrama Message